*‘It won’t be very bad’ if meeting is delayed, lawmaker says

*Monetary Policy Committee lacks appointed members for quorum

14 March 2018, Lagos — For the second time this year, Nigeria’s central bank finds itself in suspense on whether it’ll have enough policymakers to be allowed make an interest-rate decision.

Senate lawmakers have agreed to start vetting President Muhammadu Buhari’s nominees to the Monetary Policy Committee, but it’s far from certain that the house will complete it in time for an announcement on borrowing costs currently scheduled for March 20. The central bank panel already lacked a quorum to decide on rates at its meeting in January as a standoff in Parliament prevented the approval of the president’s candidates.

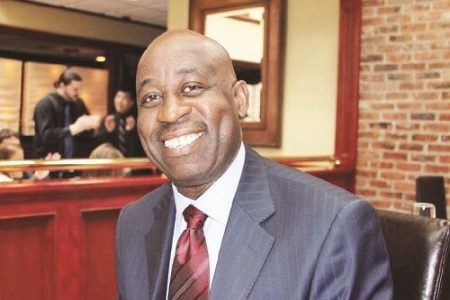

If the six nominees, who include two potential new deputy governors, submit their credentials on Wednesday, lawmakers could give notice for a sitting and screen the candidates on Thursday or March 19, Senate banking committee Chairman Rafiu Ibrahim said by phone from Abuja, the capital. The vetting will take place no later than next week, he said.

“We are aware the MPC is scheduled to meet on Monday but we have to follow the due process,” Ibrahim said. “It won’t be very bad if the meeting is delayed for a while.”

The Senate and the presidency continue to be locked in a political standoff. Lawmakers believe Buhari is out to undermine their role, partly by selectively targeting them in his anti-corruption campaign that dragged Senate President Bukola Saraki to court to answer to allegations that he hid assets. The Senate has twice rejected Buhari’s nomination of Ibrahim Magu to head an anti-graft body and delayed the approval of the nation’s budget in 2016 and 2017.

Nigeria’s central bank finds itself vulnerable to a political stasis that counterparts in larger economies have managed to avoid during a cycle of appointments around the world in recent months, including U.S. Federal Reserve Chairman Jerome Powell and future European Central Bank Vice President Luis de Guindos.

Of concern to investors is the need to assess the monetary policy rate that’s been at a record high of 14 percent since July 2016, and the approval of 2018 spending plans. The MPC has kept borrowing costs high to try to balance fighting inflation and stemming a drop in the naira with supporting an economy that’s recovering from a contraction in 2016.

Missing a second MPC meeting because of the absence of quorum might be “damaging to investor perceptions of Nigeria,” said Razia Khan, head of macroeconomic research at Standard Chartered Bank Plc. “The hope, from an economic management perspective, is that we see the newly-formulated MPC as well as more rapid passage of the 2018 budget. The later is even more important than potential easing in terms of its likely, more immediate impact on growth.”

*David Malingha Doya – Bloomberg