Princewill Demian, with agency reports

13 March 2018, Sweetcrude, Abuja – West African nation, Ghana, has been tipped to become the world’s fastest growing economy in the next few years due to its ability to efficiently deploy its oil revenue to grow other sectors of the economy, including agriculture.

According to the International Monetary Fund (IMF), in 2018, Ghana’s projected growth is between 8.3 and 8.9 percent, with only Bhutan, a South Asian country, predicted to have a higher growth than that.

Ghana’s bright fortunes, a latest New York Times report said, are hinged on its increased crude oil production and rising prices in the global market.

“In the last 18 months, two major oil fields off Ghana’s coast have started production,” the report stated.

In 2017, production jumped to nearly 60 million barrels, resulting in oil export revenues growth of 124 percent above the previous year, the Time Magazine reported, quoting data from Ghana’s central bank.

In January, Ghana’s benchmark stock index “achieved the world’s highest rate of growth” at 19 percent.

In addition, the New York Times report stated that the country is set to outpace both India with its “booming tech sector” and Ethiopia’s agriculture and coffee export-driven growth.

If this projection becomes a reality, Ghana would have succeeded in displacing Nigeria in efficient management of oil resources, despite the latter’s over 60 years of oil production and exploration which has failed to impact on any sector of the economy.

According at an Aljazeera report, Nigeria is the world’s biggest offender for failing to put its oil profits back into services such as education.

Experts have however expressed concern on the negative effect of the “resource curse” taking hold of Ghana’s burgeoning economy. They noted that the country’s agricultural sector is also experiencing significant growth as local producers tap from oil wealth to increase cocoa production, an abundant natural resource of the West African country.

“Cocoa sales are helping lift Ghana’s agriculture sector, which at the end of last year posted its best quarter of growth since 2010, driven by a bumper cocoa crop,” the report noted.

“Cocoa prices, along with prices for another of Ghana’s exports — gold — are rising again.” This they argued also cannot be said of Nigeria where corruption has lead to waste of huge oil revenue in over 60 years of exploration.

The New York Times report may not be unconnected with Nigeria’s low ranking in the doing business index, poor infrastructure and a controversial industry policy, oil majors are exploring other frontiers in search of stable and secure sources of crude oil.

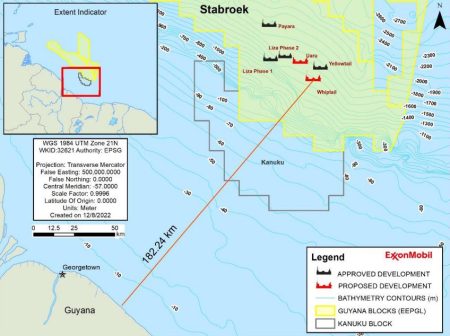

The latest of such moves involves Exxon Mobil Corp which has agreed to buy a $4 billion stake in an oil field off the coast of Ghana, as the global energy giant seeks a foothold in the new oil-producing region.

Already, the situation in the Niger Delta has driven investment that would have come to Nigeria to neighbouring countries of Angola and now Ghana because of peaceful investment climate in those places.

There have been series of attacks and high level of insecurity that have led suspension of some of the projects that should have been completed years back.

The deal is Exxon’s first major purchase in a decade and appears to highlight that the company believes oil prices will rise over the long term. Some energy analysts have asserted that weak demand for the fuel can’t support even the current price of $70 a barrel. A spokesman for Exxon declined to comment.

People briefed on the deal said that while the parties have reached a binding agreement, the deal hasn’t yet been completed and is therefore subject to change. One outstanding issue is that the Ghanaian national oil company has the right to increase its stake, according to a person involved in the transaction.

The seller is Dallas-based Kosmos Energy, which was part of a group that made the 2007 offshore discovery that is estimated to hold 1.8 billion barrels of oil. Anadarko Petroleum Corp. and Tullow Oil plc also own separate stakes in the field, known as Jubilee.