*Purchaser to acquire debt of $144 million

OpeOluwani Akintayo

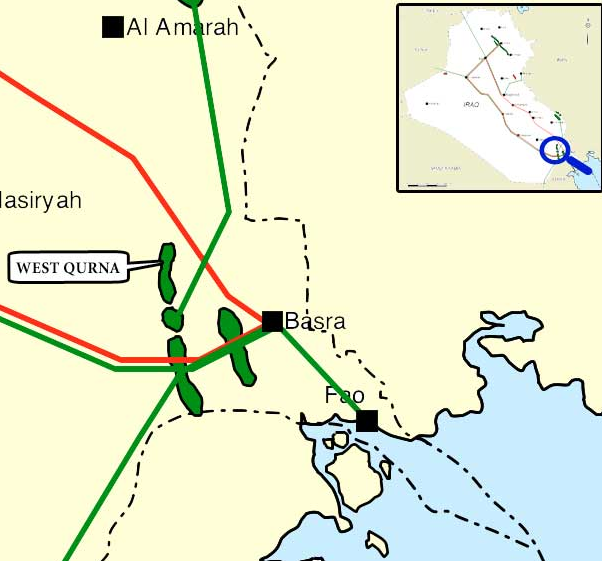

25 March 2018, Sweetcrude, Lagos — Shell Exploration & Production Middle East Holdings B.V. has agreed to sell the entire share capital of Shell Iraq B.V (SIBV), which holds its 19.6% stake in the West Qurna 1 oil field.

A statement released by Shell Global over the weekend, disclosed that the field will be sold for $406 million, to a subsidiary of Itochu Corporation.

Itochu Corporation which is the second-largest Japanese sogo shosha after Mitsubishi Corporation based in Umeda, Kita-Ku, Osaka and Aoyama, Minato, Tokyo.

The divestment scope covers Shell Iraq BV, which is 100% owned by Shell EP Middle East Holdings B.V. (“SEPMEH”) and holds a 19.6% working interest in West Qurna 1 (“WQ1”) Technical Service Contract (“TSC”) in Iraq. Other partners in the TSC are ExxonMobil (32.7%), PetroChina (32.7%), Pertamina (10%) and Oil Exploration Company (5% state partner).

On completion of the sale of SIBV, Shell will have no participating interest in the TSC and will have completely divested its interest in West Qurna 1.

The purchaser will also assume the debt of $144 million as part of the transaction.

According to Shell, the sale has received the necessary regulatory consent is expected to be rounded up in the next few days and has an effective date of 31 December 2015.

Since joining the project in 2009, Shell has “enjoyed successful cooperation” with its partners in the West Qurna 1 venture, which will continue to be operated by ExxonMobil.

Speaking on the sale, Shell’s Upstream Director, Andy Brown, said it is putting up the field for sale to allow it focus on other things.

“Iraq is an important country for the Shell Group, and exiting West Qurna 1 allows us to focus our resources on other assets in our Iraq portfolio. We are grateful for the support of the Iraqi government during the divestment process”.

“Shell remains committed to working with its partners to redevelop Iraq’s energy infrastructure by capturing the associated gas, through the Basrah Gas Company (BGC) Joint Venture, for domestic and regional consumption. This deal maintains the momentum behind Shell’s $30bn divestment programme and is in line with the drive to simplify our upstream portfolio and reshape the company into a world-class investment.”

Shell’s other businesses in the country will not be affected by this divestment.

On 14 September 2017, Shell Iraq Petroleum Development B.V. (SIPD) announced that the Ministry of Oil of Iraq has endorsed its recent proposal to pursue an amicable and mutually acceptable handover of the Shell interest in Majnoon, with timings to be agreed in due course.