24 August 2016,, Sweetcrude, Lagos – Even if the Organisation of the Petroleum Exporting Countries, OPEC, strikes a deal with Russia next month in Algiers to freeze oil production, success will mean a lot less than when they tried and failed four months ago, according to a Bloomberg report.

Oil has rallied more than 10 percent since OPEC announced recently that it will hold an informal meeting in Algiers, the Algerian capital, fanning speculation the group could complete a supply agreement with rival producers that sputtered in April. Iran may now drop its refusal to join a freeze after restoring most of the crude output curbed by sanctions, a development analysts say makes a deal more likely, but also less worthwhile.

“A freeze at 34 million barrels a day is not the same as one at 33 million barrels a day,” said David Hufton, chief executive officer of PVM Group in London, referring to the broker’s own estimate for total OPEC output. “It pushes the re-balancing process back at least a year.”

Saudi Arabia and Iran, whose political rivalry thwarted the previous negotiations, are together pumping about 1 million barrels a day more than in January – the proposed level of the original freeze. That additional crude has prolonged a global oversupply, preventing the market from sliding into deficit this quarter, according to Bloomberg calculations based on International Energy Agency data.

Sixteen nations representing about half the world’s oil output gathered on April 17, but talks broke down because of Saudi Arabia’s last-minute demand that Iran must also participate. Iran wasn’t at the Doha meeting because it refused to consider any limits on its production, which had only been released from nuclear-related sanctions in January.

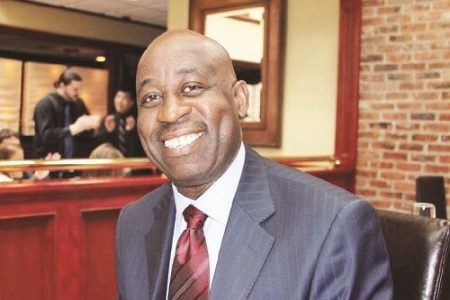

Now that major producers including Iran are pumping at or close to capacity, they have little to lose by agreeing to a cap, Chakib Khelil, former OPEC president and Algerian energy minister, said in a Bloomberg television interview.

“All the conditions are set for an agreement,” said Khelil, who steered OPEC in 2008, the last time it announced a supply cut. “Russia, Iraq, Iran and Saudi Arabia are reaching their top production level. They have gained all the market share they could gain.”

There are still reasons to think Iran could be reluctant to join a freeze.

The nation will refuse to accept any limits as long as officials insist they can boost output further, said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. Iran is also trying to attract billions of dollars of investment from international oil companies to expand production capacity, which would conflict with submitting to a cap, said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA.

Iranian Oil Minister Bijan Namdar Zanganeh hasn’t decided yet whether to participate in the talks in Algiers, a spokesman said on August 16.