Kunle Kalejaye

04 April 2017, Sweetcrude, Lagos — Nigeria’s indigenous energy group listed on both the Nigerian and Johannesburg Stock Exchange said it posted N3.5 billion profit after tax in its Financial Year End 2016 results.

The profit after tax result represents a 107 percent increase compared to N47.6 billion loss in FYE 2015.

The company also said that its turnover increased by 49 percent from N382.0 billion in FYE 2015 to N569.0 billion while its net debt reduced by 35 percent from N355.4 billion in 2015 FYE to N230.6 billion.

Oando’s upstream company, Oando Energy Resources (OER) during the year ended December 31, 2016, recorded a 20 percent decrease in total production to 15.9MMboe (average 43,503 boe/day) from 19.9MMboe (average 54,520 boe/day) compared to the same period in 2015.

“Approximately 46 percent of crude production – as at December 31, 2016, 9,590 bbls/day was hedged at $65/bbl (average) with expiry dates ranging from July 2017 to January 2019, and further upside on the condition of certain price targets being met.

“2P Reserves increased by five percent from 445mmboe in 2015 to 469.3mmboe due to reservoir performance,” the company said in it Operational Highlights for the year ended 31 December, 2016, adding that it concluded the sale of its interests in OMLs 125 and 134 to the Operators for cash proceeds of $5.5m and assumption of $88.5m in cash call liabilities due to the joint ventures.

On its midstream activities, the company said it completed the partial divestment of 49percent of the voting rights in the company’s midstream business subsidiary, Oando Gas and Power Limited (“OGP”), to Glover Gas & Power B.V., a special purpose vehicle owned by Helios Investment Partners LLP (“Helios”), a premier Africa-focused private investment firm for $115.8 million.

In addition, Oando Gas and Power (OGP) concluded the sale of Akute Independent Power Plant for a transactional value of N4.6bn.

On its downstream activities, Oando said it successfully concluded the recapitalisation of its downstream business for $210 million by HV Investments II B.V., (“HVI”), a joint venture owned by Helios Investment Partners (“Helios”), a premier Africa-focused private investment firm and the Vitol Group (“Vitol”), the world’s largest independent trader of energy commodities.

“Oando Trading witnessed continued growth resulting in a 106 percent increase in traded volumes of Crude Oil and Refined Petroleum Products, accomplished through a number of structured and well-executed initiatives.

“Physical volumes of 13 million barrels of crude oil and 3 million MT of refined petroleum products were transacted and trading revenues hit a four-year high at $1.4 billion.”

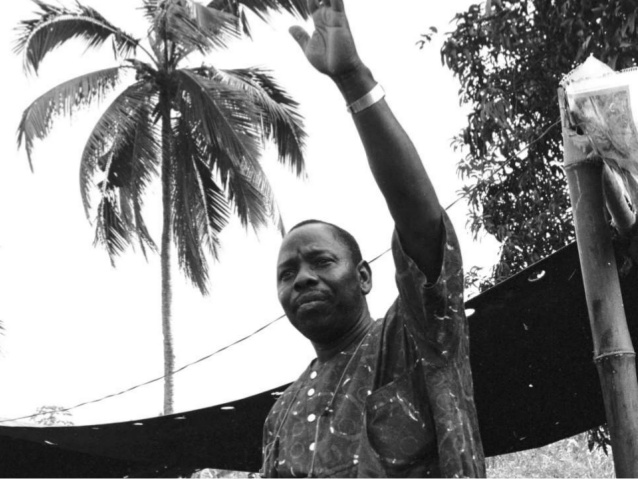

Commenting on the company’s operational highlights, the , Group Chief Executive, Mr. Wale Tinubu, said: “2016 saw the country plunge into a recession, the first in over 2 decades, besieged with liquidity constraints, devaluation of the naira and a slump in oil earnings due to low oil prices intensified by the insurgency in the Niger Delta.

“We were proactive in the timely execution of our restructuring program of Growth in our upstream division; Deleverage, through divestments resulting in a net debt reduction of N125bn; and Profitability by focusing on dollar-denominated earnings. In the, upstream we witnessed a decline in production but an increase in our 2P Reserves from 445mmboe in 2015 to 469mmboe.

“We are hopeful that the FGN will establish a long-term resolution to the conflict in the Niger Delta which will positively impact the oil and gas industry, consequently ramping up our daily production. In the Midstream we concluded the partial divestment of Oando Gas and Power (OGP) to Helios Investment Partners to further expand our gas footprint, whilst in the Downstream our trading business continued to make in-roads in crude lifting. As we enter a new phase in our business evolution we are optimistic about 2017 and look forward to more successes having braved the challenges of 2016.”