17 April 2018, Sweetcrude, Lagos — Petróleo Brasileiro S.A.’s (Petrobras) liquids production is expected to grow to 2.7 million barrels per day (mmbd) by 2021. Although in decline, the prolific Roncador field will still drive company’s oil production with over 8.3 percent share of all the production in 2021. Buzios III (Franco) and Buzios I (Franco) will follow with 5.9 percent and 5.5 percent respectively, according to GlobalData, a leading data, and analytics company.

17 April 2018, Sweetcrude, Lagos — Petróleo Brasileiro S.A.’s (Petrobras) liquids production is expected to grow to 2.7 million barrels per day (mmbd) by 2021. Although in decline, the prolific Roncador field will still drive company’s oil production with over 8.3 percent share of all the production in 2021. Buzios III (Franco) and Buzios I (Franco) will follow with 5.9 percent and 5.5 percent respectively, according to GlobalData, a leading data, and analytics company.

By 2021, 309 fields globally will be contributing liquids production to Petrobras, with the expected equity weighted production of over 2.7 mmbd and 24 new oil projects will be responsible for about 1.1 mmbd in 2021. Projects in Brazil will be responsible for 97.7 percent or 2.6 mmbd of production, followed by projects in the US with 1.2 percent (32.5 thousand barrels per day (mbd)) of production in 2021.

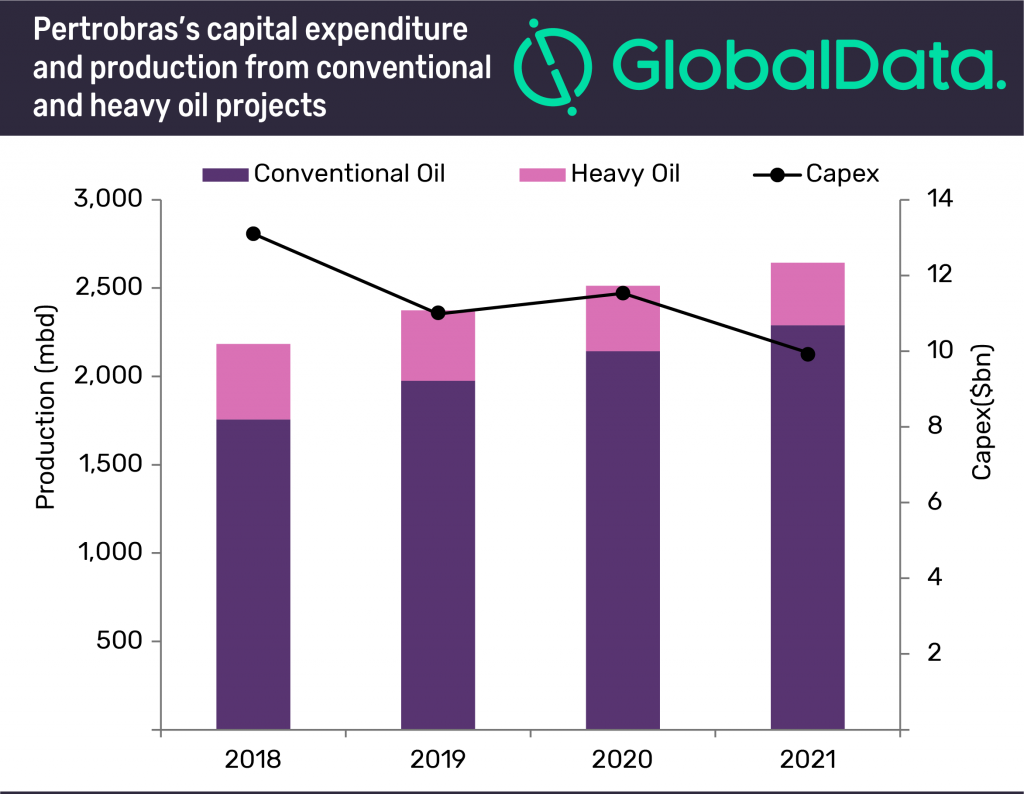

Conventional oil and heavy oil fields will be responsible for 2.6 mmbd of production in 2021, while condensate from conventional gas developments will contribute 16.8 mbd to Petrobras’s liquids production by 2021. Ultra-deepwater fields contribute about 69.3 percent, while deepwater fields contribute around 24.1 percent of the total liquids production. Shallow water and onshore fields contribute about 3.6 and 3.0 percent, respectively.

Petrobras is expected to spend $45.6bn between 2018 and 2021 on conventional and heavy oil projects, with capex peaking in 2018 at $13.1bn. Venezuela is expected to have the highest remaining capex per barrel of oil equivalent (boe) with $58/boe, whereas projects in which Petrobras has participation have low remaining recoverable reserves, as those fields are at the final part of their productive life. The company’s projects in the US are expected to have the lowest average remaining capex per boe at $3.2/boe. The projects in Argentina, Brazil, Bolivia and Nigeria are forecast to have the remaining capex of $6.6, $6.1, $5.6 and $5.3 per boe respectively.

Among the fields in which Petrobras has equity stake, the ultra-deepwater Roncador field in Brazil is the major oil producing field with expected contribution of about 220.2 mbd of oil in 2021. The project has a remaining break-even oil price of $25 per barrel.

Another important field is the ultra-deepwater pre-salt Libra Noroeste (Mero) project, which will contribute approximately 39.1 mbd of oil to Petrobras by 2021. The company’s share of remaining recoverable oil reserves from the field total 643 million barrels of oil. Libra Noroeste (Mero) has a remaining break-even oil price of $35 per barrel.

Buzios III (Franco) also in Brazil is one of the major ultra-deepwater oil producing fields, which is expected to contribute around 156.5 mbd of oil in 2021 with the remaining break-even of $23 per barrel of oil.

Another ultra-deepwater oil producing Buzios I (Franco) field in Brazil is expected to contribute about 146.5 mbd of oil by 2021 with the remaining break-even oil price of $32 per barrel.