*Apicorp plans to diversify investments outside the Gulf: CEO

*Investment company will finance projects using bonds and Sukuk

10 January 2019, London — Arab Petroleum Investments Corp. plans to invest almost $1 billion in energy projects this year, boosting its assets even as oil prices falter.

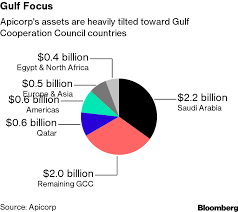

New investments will diversify the portfolio away from the oil-rich Persian Gulf and into Iraq, Libya, Egypt, Morocco, and the U.S., said Ahmed Ali Attiga, chief executive officer of the multilateral investment company known as Apicorp.

Borrowings by energy producers in the six-nation Gulf Cooperation Council plunged 24 percent last year as oil prices hit a four-year high. Apicorp’s assets grew in 2018, rising 13 percent as the company chased a share of what it forecasts will be a five-year, $919 billion investment spree for energy projects in the Middle East and North Africa.

“These projections will be maintained for the region in 2019,” and oil prices won’t alter them much, Attiga said in an interview in Abu Dhabi. “The price of oil is rebounding, and I think it will settle in a range that is conducive to making the bulk of the investments happen.” Brent crude tumbled 42 percent from Oct. 3 and has been paring losses since late December.

Apicorp plans to borrow under its existing $3 billion bond and $3 billion Sukuk programs to finance the investments, Attiga said. The company has already raised $500 million in Sukuk and $750 million in that bond program.

Apicorp plans to borrow under its existing $3 billion bond and $3 billion Sukuk programs to finance the investments, Attiga said. The company has already raised $500 million in Sukuk and $750 million in that bond program.

While geographic expansion is the focus for 2019, Apicorp’s CEO is also eager to acquire assets beyond its traditional investments in oil, natural gas, and power projects.

“I hope my success will be measured by how much we can grow, particularly in the areas where we are seeing the transformation of the energy sector in this region: renewables, energy efficiency, technology and anything related to it,” said Attiga.

Investment Surge

Apicorp’s assets are growing even as the oil rebound stutters

Apicorp, based in Dammam, Saudi Arabia, is owned by the Organization of Arab Petroleum Exporting Countries, with Saudi Arabia, Kuwait, and the United Arab Emirates each holding 17 percent, according to its website.

*Verity Ratcliffe and Mohammed Aly Sergie – Reuters