17 January 2019, Sweetcrude, Lagos — China will drive the majority of growth in the crude oil refining industry in Asia between 2018 and 2023, contributing 44% of Asia’s crude oil refining capacity in 2023, according to GlobalData, a leading data, and analytics company.

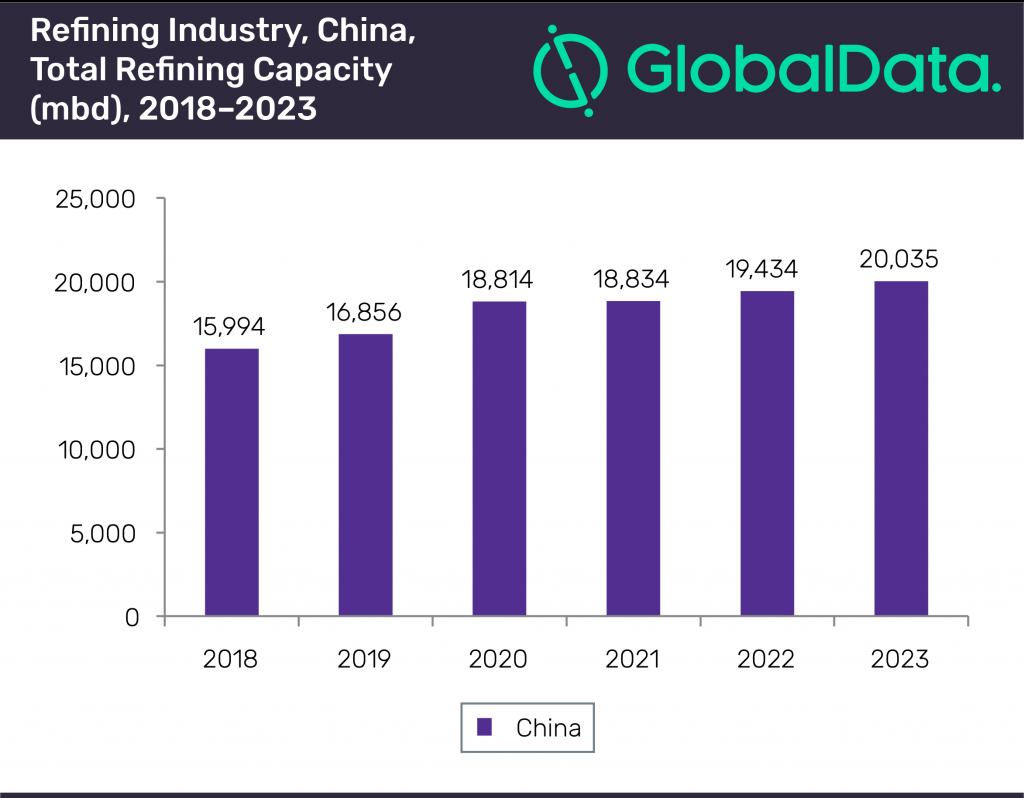

The company’s report: ‘China Crude Oil Refinery Outlook to 2023’ reveals that the total refining capacity of China in 2018 was 15,994 million barrels per day (mbd), which was 46% of Asia’s total refining capacity in 2018. The country’s total refining capacity is forecast to increase at an average annual growth rate (AAGR) of 4.5% to 20,035 mbd in 2023. China’s planned crude oil refining capacity is also expected to increase from 460 mbd to 3,721 mbd during the outlook period.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, comments: “China is expanding its refinery capacity due to its industrial growth, and growing demand from the transportation sector. The refining capacity additions will drive China’s crude imports, and will further improve the country’s capability to export petroleum products.”

GlobalData also forecasts that China’s total crude distillation unit capacity will increase from 15,954 mbd in 2018 to 19,994 mbd in 2023. There will be no condensate splitter capacity additions in China during the outlook period, which will remain the same at 36 mbd.

The country’s total coking capacity, catalytic cracker capacity, and the hydrocracking capacity is expected to increase during the outlook period. The total coking capacity is expected to increase from 1,991 mbd in 2018 to 2,371 mbd in 2023. China’s total catalytic cracker unit capacity is expected to increase from 4,359 mbd in 2018 to 5,532 mbd in 2023. Over the five year period, the hydrocracking unit capacity of the country is set to increase to 2,922 mbd from 1,846 mbd.

China has a total of 179 active crude oil refineries and around 12 planned and announced refineries are expected to commence operations by 2023. The top three active refineries in China, in terms of the crude distillation unit capacity, are Maoming, Zhenhai, and Huizhou with 472 mbd, 462 mbd, and 440 mbd, respectively. Dayushan Island refinery will be the largest planned refinery with a planned crude oil refining capacity of 800 mbd in 2023, followed by Dalian III and Jieyang with 400 mbd each.