Newswire — Brazilian oil major Petrobras has received $1.12 billion from Shell’s Brazil subsidiary as compensation for the 25 percent stake in the Atapu block.

The Atapu block was acquired by the consortium composed of Petrobras which holds a 52.5 percent stake, Shell which holds 25 percent, and the remaining 22.5 percent is held by TotalEnergies.

The stakes were awarded in the 2nd Bidding Round for the Transfer of Rights surplus under the Production Sharing Regime on December 17, 2021.

Petrobras said that it expected to receive the full payment regarding TotalEnergies’ stake. The signing of the Production Sharing Contract and the Coparticipation Agreement is expected to occur by April 29, 2022.

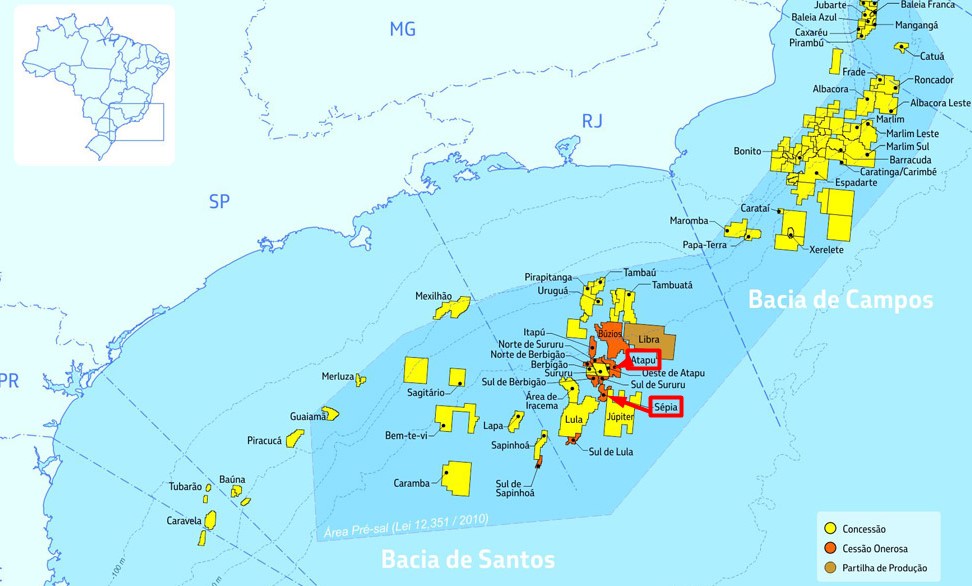

The Atapu field is a pre-salt oil field in the Santos Basin, located in water depths of about 6,500 feet. Production started in 2020 and has reached a plateau of 160,000 barrels per day with a first floating, production, storage, and offloading vessel (FPSO).

A second FPSO is planned to be sanctioned, which would increase the overall oil production of the field to around 350,000 barrels per day.

The stake for the Atapu field was awarded on the same day as the stakes to the Sepia fields. There, TotalEnergies now holds a 28 percent interest. The two partners, apart from operator Petrobras with its 30 percent stake, are QatarEnergy with 21 percent, and Petronas with 21 percent.

The consortium won the rights to help expand Sepia by offering 37.43 percent in so-called profit oil to the government. Petrobras already operates the field and exercised its rights to a 30 percent stake.

Production at Sepia started in 2021 and is targeting a plateau of 180,000 barrels per day with a first FPSO. A second is planned to be sanctioned, which would increase the overall oil production of the field to around 350,000 barrels per day.

Sweeter terms and higher oil prices have enhanced the appeal of Brazil’s offshore oil trove which includes some of the world’s largest oil discoveries this century.

As recently as November 2019, Sepia and Atapu failed to attract bidders in what was possibly the world’s priciest oil auction, with signing bonuses alone totaling $9 billion. The prospects are part of an area estimated to hold as much as 15 billion barrels of recoverable crude, according to a study by Houston-based consultancy Gaffney, Cline & Associates. That also includes Petrobras’s Buzios and Itapu fields.

It is worth noting that Atapu and Sepia are part of an area estimated to hold as much as 15 billion barrels of recoverable crude and are in an area that already produces oil. Petrobras is producing from a block bordering Sepia while Total, Galp, and Shell are partnering with the Brazilian giant in a block bordering Atapu.

*email [email protected]

Follow us on twitter