London — Global oil demand is edging up slowly but is set for a huge boost from resumed air travel and China’s economic reopening after COVID-19 curbs, the International Energy Agency said on Wednesday.

“Global oil demand growth started 2023 with a whimper but is projected to end the year with a bang,” the Paris-based agency said in its monthly oil report.

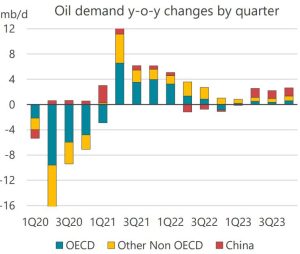

“Rebounding jet fuel use and a resurgent China will see an overall 1Q-4Q ramp-up of 3.2 million barrels per day (bpd), the largest relative in-year increase since 2010.”

“Rebounding jet fuel use and a resurgent China will see an overall 1Q-4Q ramp-up of 3.2 million barrels per day (bpd), the largest relative in-year increase since 2010.”

The agency kept its forecasts for Chinese and global demand relatively steady from the previous month, at 16 million bpd and 102 million bpd, respectively.

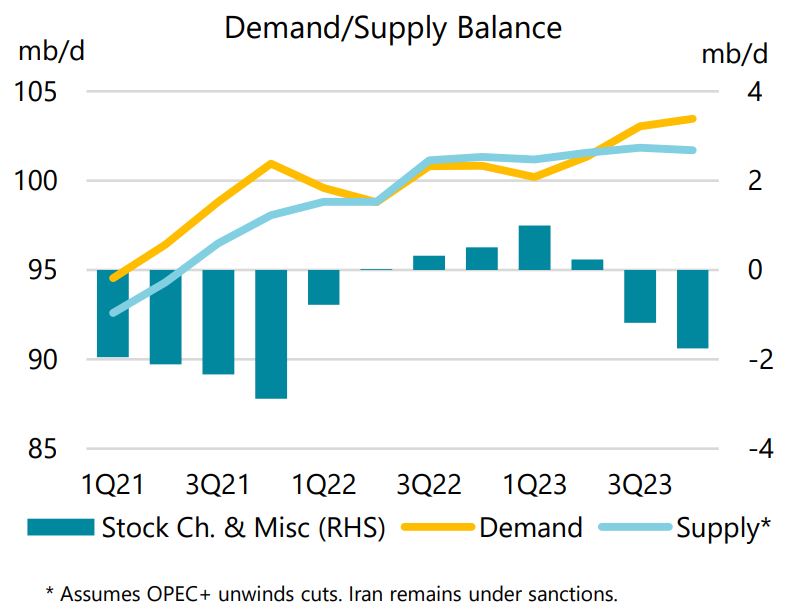

Oil supply is still outstripping relatively slow demand, the IEA added, but the market is set to balance by around the middle of the year with China and developing countries driving demand.

“Real-time indicators for Chinese mobility mostly stabilised after January’s remarkable bounce, led by air traffic with domestic flights now well above pre-pandemic levels,” the IEA said.

High inflation and investor concerns over high interest rates cloud the economic horizon and could pose a risk to fuel demand, the IEA warned, adding that concerns over the health of the U.S. banking sector also carried potential downside risks.

Meanwhile commercial oil stocks in the developed countries of the OECD reached an 18-month high as demand ebbed and Europe ramped up storage ahead of bans on some Russian crude and refined products imports.

Russian oil production stayed near pre-war levels in February despite sanctions on its seaborne exports.

Still, crude exports fell 500,000 bpd while a new European Union ban on its seaborne products and a U.S.-led international price cap – both starting on Feb. 5 – cut Russian products exports by 650,000 bpd.

*Noah Browning; editing: Jason Neely – Reuters

Follow us on twitter