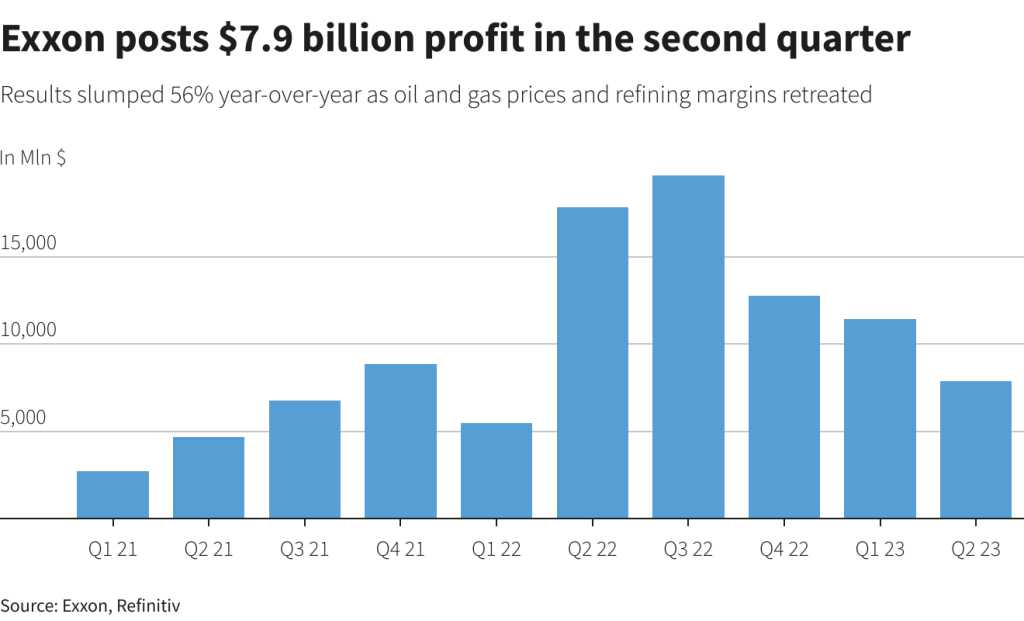

Houston — Exxon Mobil Corp (XOM.N) on Friday reported a 56% slump in second-quarter profit, missing Wall Street bets and joining rivals hurt by a sharp drop in energy prices and lower fuel margins.

Second-quarter results from oil majors have tumbled from huge profits booked a year ago after Russia’s invasion of Ukraine sent oil and gas prices soaring.

Chevron Corp (CVX.N), Shell (SHEL.L) and TotalEnergies (TTEF.PA) have reported profit falls of 48%, 56% and 49%, respectively.

Shares of Exxon and Chevron were down less than 1% in pre-market trading in the absence of positive surprises.

“Results came in slightly weaker than expected across earnings and cash flow,” RBC analyst Biraj Borkhataria wrote in a note. “We would expect Exxon to underperform the peer group today”.

Borkhataria said Friday’s full results from Chevron, which had posted its main numbers on Sunday, were neutral.

Net income was $7.88 billion, or 1.94 cents per share versus a record $17.85 billion a year earlier. Wall Street was expecting $2.01 per share, Refinitiv Eikon data showed.

Yet excluding last year’s record second quarter, Exxon posted its strongest result for the months of April to June in more than a decade, helped by cost cuts and the sale of less profitable assets.

“That is quite a good quarter for us,” Chief Financial Officer Kathryn Mikells told Reuters. Last year aside, she noted: “You would have to go back to the second quarter of 2011 to find the last time we produced this level of earnings in the second quarter.”

Benchmark Brent crude prices averaged $80 a barrel, down from $110 a year earlier. Prices for liquefied natural gas (LNG) fell to $11.75 per million British thermal units (mmBtu) from around $33.

“Lower natural gas realizations and industry refining margins adversely impacted earnings,” Exxon said in its earnings statement.

“Industry margins declined sequentially from a strong first quarter on weaker diesel margins as Russian supply concerns eased,” the company said, pointing to earnings in Energy Products of $2.3 billion, down $1.9 billion from the first quarter.

Helping offset that was a jump in earnings in Chemical Products to $828 million from $371 million in the first quarter helped by lower feed costs, it said.

Exxon’s oil production stands at 3.7 million barrels of oil equivalent per day (boed) year to date, in line with the company’s annual target, Mikells said.

Results were helped by better output in the U.S. Permian basin, which delivered 622,000 boed in the quarter, and in Guyana, where Exxon plans to increase production by 5% to 400,000 boed by year end.

Capital and exploration spending was $6.2 billion in the second quarter and $12.5 billion for the first half of 2023, in line with the company’s full-year guidance of $23 billion to $25 billion, the company said.

The company has achieved cumulative structural cost savings of $8.3 billion from 2019 levels, nearing its $9 billion target.

Exxon earlier this month said it would buy gas pipeline company Denbury Inc (DEN.N) for $4.9 billion to accelerate its energy transition business with carbon capture and storage (CCS) operations.

The oil giant distributed about $8 billion in cash to shareholders in the second quarter including about $3.7 billion in dividends.

“We are very comfortable overall with our capital allocation approach,” Mikells said. “So we’re committed to continuing that balanced approach.”

*Sabrina Valle; editing: Sonali Paul & Jason Neely – Reuters