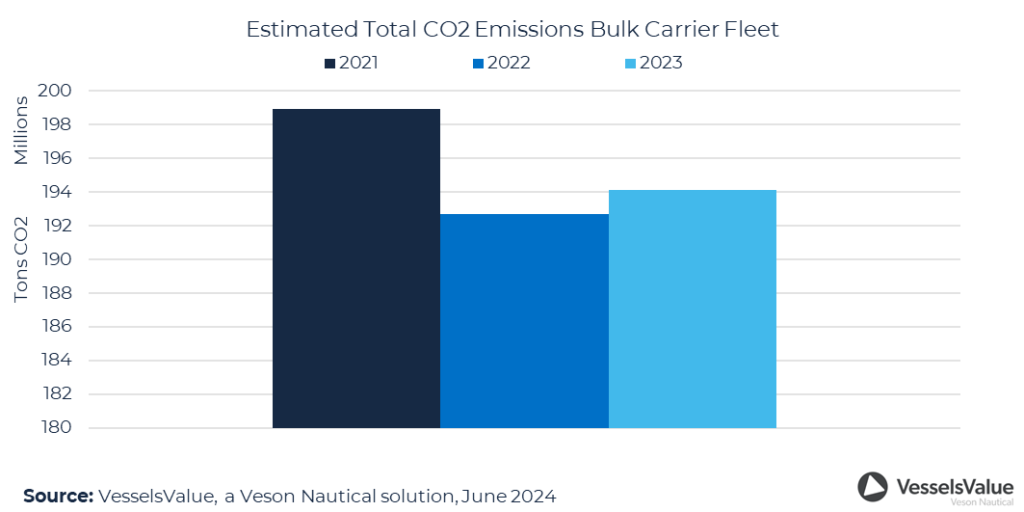

Lagos — Estimated carbon emissions from bulk carrier vessels have fallen by 5 million tonnes, or 2.5%, since the beginning of 2021, despite an increase in the distance travelled and time spent underway according to new research by Veson Nautical (Veson), a global leader in maritime data and freight management solutions.

The research, published in a whitepaper titled ‘How are the CII and EEXI Regulations Influencing a Strong Bulk Market?’ cites a reduction in average speed by bulk vessels in order to be in compliance with efficiency regulations imposed by the International Maritime Organization (IMO) as the main driver of this change.

“The cubic relationship between speed and required power means that higher speeds result in proportionally higher fuel consumption,” says Oliver Kirkham, Valuations Analyst at Veson’s marine valuation and market intelligence provider VesselsValue, “The consistent decrease in average speed across the fleet from 2021 is therefore a key contributory factor in the decrease in total CO2 emissions.”

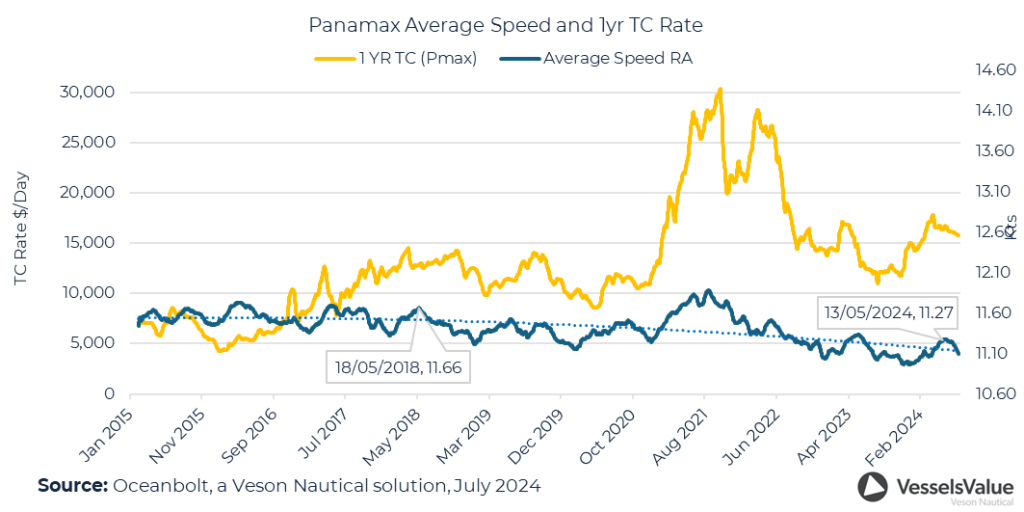

Kirkham adds that large bulk carrying Panamax class vessels have seen their average speed decline from 11.66kts in 2018, to 11.27kts in 2024 year-to-date, a decrease of 3.3% compared to 2018. This is despite charter rates for the same vessels reaching a peak of $17,815/day in April 2024 , an increase of 23% compared to peak rates of $14,500/day reached in 2018.

“Similar trends are observed in the Capesize and Supramax sectors,” Kirkham says. “This suggests that a reduction of sailing speed has been a driving factor in the overall increase in operational efficiency observed amongst the bulk carrier fleet.”

The whitepaper also suggests that the main drivers are new rules aimed at lowering the carbon intensity of large bulk vessels. The introduction of the Carbon Intensity Indicator (CII) regulation by the IMO has provided the first standardized operational efficiency metric for the shipping sector, which gives vessels ratings based on fuel oil consumption, speed and distance figures collected over the year.

The whitepaper also suggests that the main drivers are new rules aimed at lowering the carbon intensity of large bulk vessels. The introduction of the Carbon Intensity Indicator (CII) regulation by the IMO has provided the first standardized operational efficiency metric for the shipping sector, which gives vessels ratings based on fuel oil consumption, speed and distance figures collected over the year.

From 1 January 2023, the IMO made it mandatory for all existing ships to calculate their attained Energy Efficiency Existing Ship Index (EEXI) to measure a vessel’s technical energy efficiency and initiated the reporting and assignment of CII ratings. The EEXI scheme placed a requirement on shipowners to modify non-compliant vessels to meet the newer, more stringent efficiency design criteria stipulated in the EEXI regulations.

“For older vessels the most effective and economic way forward has been to install engine power limitation (EPL) tools which has resulted in slower average speeds and compliance with the new regulations,” says Kirkham.

The report concludes that as more pressure is put on ship owners to clean up their fleets, a two-tier charter market where premium rates are paid for newer, less carbon-intensive vessels.

“Analysis of our specifications database shows that, currently, 99% of active bulk carrier vessels are operating on single fuel engines,” says Kirkham. “This is a “baseline scenario” for which our verified model provides estimated fuel consumption figures meaning the effect of dual fuel engines on fleet-wide CO2 emissions is assumed to be minimal at present in the bulk carrier sector.”