*Seplat pushes to buy

OpeOluwani Akintayo

01 April 2018, Sweetcrude, Lagos — Addax Petroleum is looking to sell off Oil Mining Lease, OML 124 located onshore Eastern Nigeria.

According to African Oil & Gas Report, Seplat Petroleum is interested in acquiring Addax Petroleum’s Oil Mining Lease (OML) 124, onshore Eastern Nigeria and it is willing to acquire the oil field once it is sure that Sinopec, Addax’s parent company, is divesting the company’s assets in Nigeria and Gabon as being speculated.

The report said Seplat has already contacted BNP Paribas, the bank reportedly handling the sale of the assets, to finalise the buy.

However, recent reports say the French bank had already pulled out of the deal.

“We were told they (the bank) didn’t have the mandate”, a Seplat source told the medium.

Although Colin Klappa, Addax Nigeria’s new Chief Executive Officer is reportedly not willing to the sale of Addax’s hydrocarbon assets in Nigeria, the matter may be out of his hands.

Call and text message sent by SweetcrudeReports to Addax’s Acting Coordinator Public Relations & Communication, Kingsley Onoyom received no response as at the time of publication.

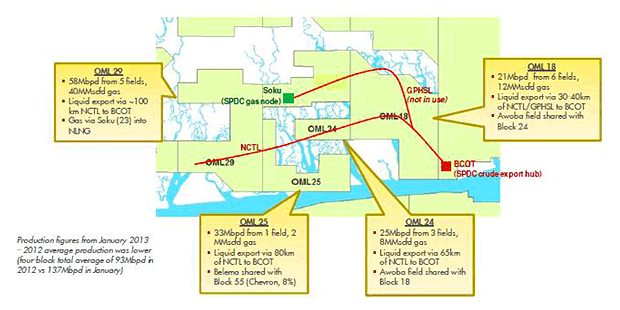

OML124, Addax Petroleum’s sole onshore property in Nigeria, is located in Imo State approximately 100 km north of Port Harcourt.

The oil field is Addax Petroleum’s smallest Nigerian license area when measured by production.

This is not the first time reports of the company divesting its assets in Nigeria have made the rounds.

However, the firm whose chief executive officer and legal director, Geneva, was arrested in Geneva and charged with bribing of Nigerian officials, have kept denying making plans to leave the shores of Nigeria.

The company sued by Nigeria, have since been fined the sum of $32 million.

In 2015, the Petroleum and Natural Gas Senior Association of Nigeria, PENGASSAN, also blew the whistle against Addax over an alleged capital flight.

According to the group, the company had allegedly used its sister firm, Kaztec Engineering Limited, to repatriate over $2 billion out of the country.

However, no form of investigation was launched since the allegation.

Earlier in March, the federal government, through the office of the Attorney-General of the Federation, had commenced legal proceedings against the company over the company’s alleged under-remittance of $3 billion in taxes and royalties.

According to documents presented in court before Justice Mojisola Olatoregun, the funds were outstanding claims against the company under the Petroleum Profit Tax Act and Petroleum (Drilling and Production) Amendment Regulation 2003 over Oil Mining Leases (OMLs) 123, 124, 126, and 137.