*Company must convert ‘in principle’ agreements into contracts

*Exxon’s entry is positive for Mozambique as a global supplier

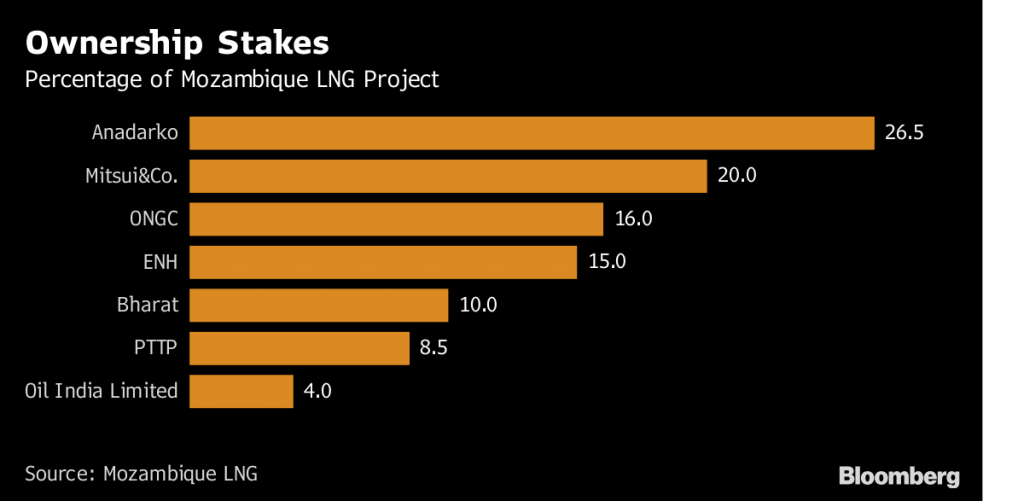

29 April 2018, London — Anadarko Petroleum Corp. said that “in principle” it has enough customers to proceed with its liquefied natural gas project in Mozambique, eight years after making a major deepwater discovery there.

The development of Mozambique’s LNG potential by Anadarko, Eni SpA and Exxon Mobil Corp. is key to stimulating growth in one of the world’s poorest countries. Anadarko signed a 15-year supply deal with Electricite de France SA in February and now needs to finalize contracts with other potential clients, said Steven Wilson, vice president and country manager in Mozambique for the Woodlands, Texas-based explorer.

“We effectively have an agreement in principle for the volumes we need,” Wilson said in an interview in Mozambique’s capital, Maputo. “Now the intention is to follow the EDF transaction to be able to convert all those” into binding sales and purchase agreements.

Anadarko has also received government approvals for onshore facilities needed to export the gas. The project, estimated to require an investment of $20 billion, will start with two so-called trains with a capacity of more than 12 million tons a year, with a view of increasing to as many as eight trains producing 50 million tons.

While Wilson is optimistic about project financing, he said the resumption of the International Monetary Fund’s program in Mozambique would further boost investor sentiment toward the southern African nation. Some of the biggest natural gas discoveries in a decade off Mozambique’s northern coast has been overshadowed by the disclosure of hidden government debt in 2016, which prompted the IMF to halt funding.

Project Financing

“We’re confident that the project will be able to raise financing in the current environment,” Wilson said. “That being said, we believe that the resumption of an IMF program would be a very powerful signal to the global markets that Mozambique is committed to transparent governance; it would encourage foreign direct investment and obviously would benefit the Mozambique economy.”

Eni’s onshore LNG project picked up its own momentum in 2017 when Exxon acquired half of its stake in Area 4 offshore gas field. The Italian company also made an investment decision on a floating LNG plant. Exxon’s arrival has benefited the overall development, according to Wilson.

“It’s very positive news that Exxon Mobil has joined Area 4,” he said. “One could view it as further validation that Mozambique will become a major global supplier of LNG in the future.”

*Paul Burkhardt & Matthew Hill – Bloomberg