Cape Town, South Africa — The Sanha Lean Gas Connection Project in Angola will start production in December 2024, according to Chevron. Speaking during an Invest in Angola Energies roundtable – sponsored by the ANPG, Sonangol, Azule Energy and ACREP – at African Energy Week (AEW): Invest in African Energies 2024 on Monday, Toni Henning, Commercial General Manager at Chevron’s Southern Africa Strategic Business Unit, said that the project will deliver gas to the Angola LNG facility.

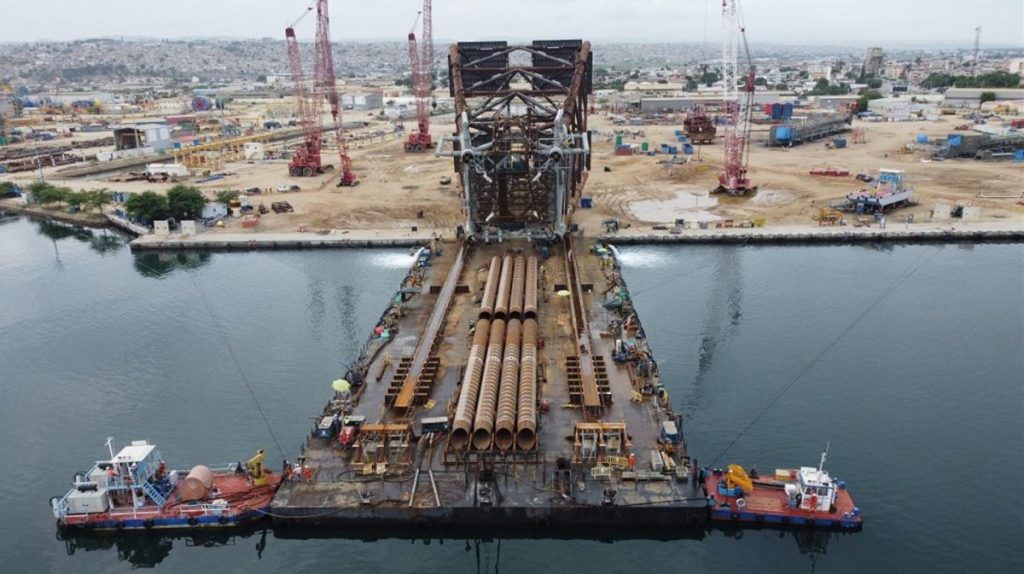

The $300 million project comprises the development of a platform that ties into the existing Sanha Condensate complex. Developed by Chevron, the project serves as part of a series of gas-focused investments the company is undertaking in Angola alongside various partners.

“We have been in Angola for 70 years and it has only been possible because of our strong partners. We lead in gas and have a couple of projects underway. Sanha Lean Gas has always been part of our gas profile in Angola. We had it fabricated in Lobito, with 1,000 direct jobs and 3,000 indirect jobs created,” Henning said.

In addition to the Sanha project, Angola’s New Gas Consortium (NGC) expects production to start at the Quiluma and Maboqueiro fields in late-2025 or early-2026, according to Adriano Mongini, CEO of NGC operator Azule Energy.

“The project is progressing well and we are planning start-up for late-2025. This is the first non-associated gas project in Angola, and hopefully, the first of many,” he said.

Beyond gas, Angola – sub-Saharan Africa’s second largest oil producer – aims to maintain production above one million barrels per day beyond 2027. To achieve this, the government is incentivizing investment in exploration, with the National Oil, Gas & Biofuels Agency (ANPG) preparing to launch its 2025 Bid Round in Q1 of next year. The round features part of a series of reforms aimed at driving exploration and production.

“We wanted to make the business environment more transparent and more competitive. We have marginal field opportunities and new legislation for gas, making it possible for investors to have gas rights,” said Alcides Andrades, Executive Board Member, ANPG.

Through its multi-faceted investment approach, Angola is consolidating its position as an oil and gas heavyweight, and recent developments point to that. TotalEnergies and project partners on the Kaminho Development in Block 20/11 made $6 billion FID in 2024, for example.

According to Rui Rodrigues, Director, TotalEnergies EP Angola, “the significance of the Kaminho project is that we are opening a new province in Angola. The majority of Angola’s production is derived from the north, but with Kaminho, we are diversifying supply.” He added that TotalEnergies is “on track to deliver the project by 2028.”

TotalEnergies also anticipates the Begonia field development to start production in the coming months. McDermott International is leading the EPC support for the project. Mahesh Swaminathan, Senior Vice President: Global Business Vertical Head at McDermott International explained that “from an engineering perspective, we are nearly done. The vessel will enter any time soon. We are nearly completed and it’s an exciting development.”

In addition to Begonia, McDermott International is focusing on capacity building in Angola. Swaminathan said that “We are setting up an engineering office in Angola, where we will train engineers from across the world.”

Beyond Kaminho, Angola has an exciting pipeline of projects underway. Katrina Fisher, Lead Country Manager and General Manager at ExxonMobil, shared insight into Block 15 – one of Angola’s longest-producing assets.

“We celebrated our 30th anniversary of Block 15 in August 2024 and we also recently made a discovery – Likember-01 – at the block, representing our 19th discovery at Block 15. With this, we have increased our production by 30% and offset decline.”

Angola’s NOC Sonangol – in addition to driving upstream projects – is committed to boosting refining capacity in Angola. Sonangol’s Board Director Kátia Epalanga said that “We are seeking more than 400,000 bpd in refining capacity by 2027. The three new refineries underway will help us reach this capacity.”

For international service companies such as SLB, Angola is ripe with opportunity. According to SLB’s Managing Director – Central, East and Southern Africa, Miguel Baptista, “In 2024, we celebrated 55 years of operations in Angola. We continue to see a lot of activity happening across the life of the oilfield. With this, there is good opportunity for the industry to push the boundaries of technology.”

Angola also represents an exciting market for independents. Afentra, for example, which entered the market three years ago, is “focusing on growth in Angola: growth on the Kwanza Basin, growth on Block 3/05 and growth with regards to new deals,” according to the company’s COO Ian Cloke. Cloke considers Angola to be “a fantastic market to be in.”

The same can be said for AA&R Investment, which has not yet entered the Angolan market. Abdullahi Bashir, Haske Group, the company’s Managing Director, explained that “Angola is the right place to be and we are looking for opportunity there. We are looking at onshore and offshore blocks and we are looking at participating in the bid round.”