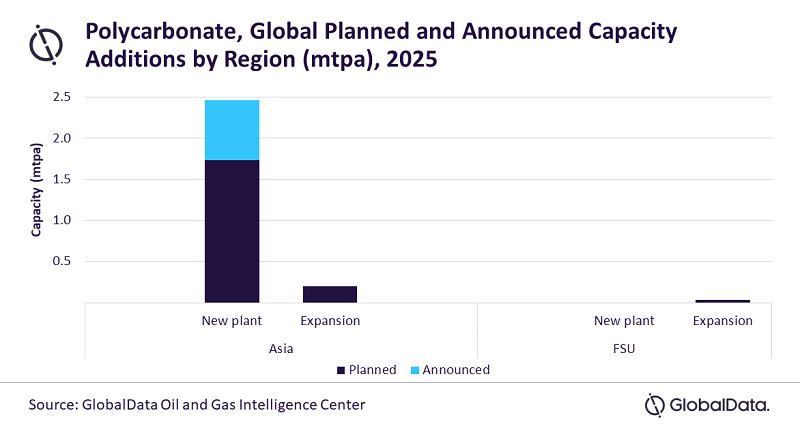

Lagos — Asia is likely to lead the global polycarbonate capacity additions with a capacity of 2.66 million tons per annum (mtpa) by 2025. In Asia, China accounts for more than half of the region’s capacity additions and it is expected to lead the global polycarbonate capacity additions among the countries, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Polycarbonate Market Size and Forecast, 2021-2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’ reveals that Asia has 11 new- build and expansion projects with 2.46 mtpa from new build and 0.20 mtpa from expansion projects.

GlobalData’s report, ‘Global Polycarbonate Market Size and Forecast, 2021-2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’ reveals that Asia has 11 new- build and expansion projects with 2.46 mtpa from new build and 0.20 mtpa from expansion projects.

Vinuthna Bidar, Oil and Gas Analyst at GlobalData, says: “In China, nine new-build and expansion projects are likely to start operations with a capacity of about 1.93 mtpa by 2025. Majority of the capacity additions are from Shenma Industrial Company Kaifeng Polycarbonate Plant and Shenma Industrial Company Pingdingshan Polycarbonate Plant, with the capacity of 0.40 mtpa each. They are expected to commence production of polycarbonate in 2022.”

GlobalData identifies India as the second highest country in terms of capacity additions with a capacity of 0.73 mtpa by 2025. Majority of the capacity additions will be from an announced project, Reliance Industries Jamnagar Polycarbonate Plant, contributing 0.60 mtpa. It is expected to commence production of polycarbonate in 2025.

Russia will be the third highest country in terms of capacity additions with the capacity of 0.04 mtpa by 2025. Majority of the capacity additions will be from a planned project Kazanorgsintez Kazan Polycarbonate Plant, with the capacity of 0.04 mtpa. It is expected to come online in 2022.

Shenma Industrial Co Ltd, Reliance Industries Ltd and Covestro AG will be the top three companies globally in terms of planned and announced capacity additions over the outlook period.

Follow us on twitter