Lagos — Total oil & gas industry M&A deals in Q4 2020 worth $10.01bn were announced in Canada, according to GlobalData’s deals database.

Lagos — Total oil & gas industry M&A deals in Q4 2020 worth $10.01bn were announced in Canada, according to GlobalData’s deals database.

The value marked an increase of 468.3% over the previous quarter and a rise of 504.2% when compared with the last four-quarter average of $1.66bn.

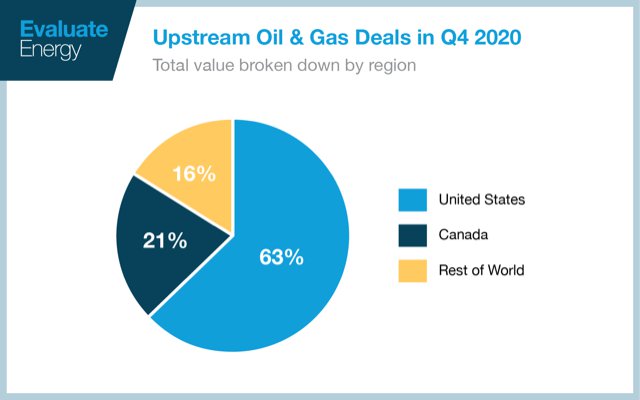

Canada held a 13.7% share of the global oil & gas industry M&A deal value that totaled $73.03bn in Q4 2020.

In terms of deal activity, Canada recorded 27 deals during Q4 2020, marking a rise of 3.9% over the previous quarter and a drop of 22.9% over the last four-quarter average.

Canada oil & gas industry M&A deals in Q4 2020: Top deals

The top five oil & gas industry M&A deals accounted for 95.9% of the overall value during Q4 2020.

The combined value of the top five oil & gas M&A deals stood at $9.6bn, against the overall value of $10.01bn recorded for the month.

The top five oil & gas industry deals of Q4 2020 tracked by GlobalData were:

– The $7.77bn merger of Cenovus Energy and Husky Energy

– The $703.13m acquisition of Torc Oil and Gas by Whitecap Resources

– AltaGas Idemitsu Joint Venture’s $541.73m acquisition of Petrogas Energy

– The $478.23m acquisition of Jupiter Resources by Tourmaline Oil

– Tourmaline Oil’s acquisition of Modern Resources for $108.06m.