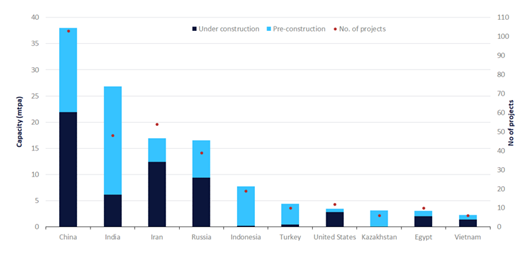

Lagos — China is set to drive the global polyolefins capacity additions, occupying a share of 29% by 2030, as both demand and supply of polyolefins are expected to grow in the country, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report “Polyolefins Market Analysis and Forecast by Products, Capacity Additions, Top Countries and Active and Upcoming Projects to 2030”, reveals that the total polyolefins capacity of under-construction and pre-construction projects in China is expected to be around 35.20 million tonnes per annum (mtpa) by 2030.

Nivedita Roy, Oil and Gas Analyst at GlobalData, comments: “The high-capacity addition of polyolefins in China is attributed to its vast manufacturing sector and the growing domestic market. With rapid industrialization in the country, there is an increased need for durable and versatile materials like polyolefins to support various sectors such as packaging, automotive, and construction.”

To meet the growing demand for polyolefins, China is planning to expand its production capacity. As a result, the polyolefins supply in the country is projected to rise from 63.17 mtpa in 2024 to 83.01 mtpa in 2030.

In China, a significant part of polyolefins capacity additions are likely to come from Fujian Eversun New Material Co Ltd. The company has proposed two plants-“Fujian Yongrong New Materials Company Putian Polypropylene Plant 1”, and “Fujian Yongrong New Materials Company Putian Polypropylene Plant 2”, with a capacity of 0.90 mtpa and 1.10 mtpa, respectively. They are expected to become operational by 2026 and 2029. Fujian Eversun New Material Co Ltd is also the operator of both projects with a 100% equity stake.

“North Huajin Refining and Petrochemical Liaoning Polypropylene Plant” and “Jinzhou Petrochemical Company Jinzhou Polypropylene Plant 3” represent other significant polyolefin capacity additions in the country with 1 mtpa and 0.90 mtpa, respectively. They are expected to come online in 2028 and 2027.