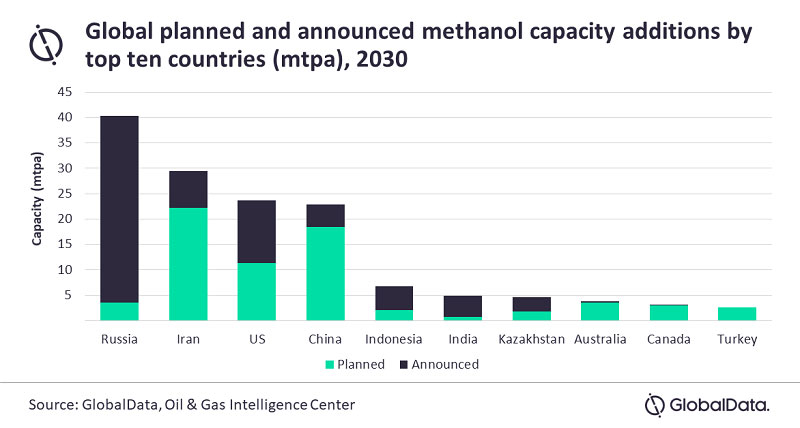

London — China is set to drive the methanol capacity additions in Asia-Pacific (APAC), occupying a share of 67% by 2030, as both demand and supply of methanol are expected to grow in the country, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report “Methanol Market Analysis and Forecast by Products, Capacity Additions, Top Countries and Active and Upcoming Projects to 2030,” reveals that the total methanol capacity of under-construction and pre-construction projects in China is expected to be around 12.28 million tonnes per annum (mtpa) by 2030.

Nivedita Roy, Oil and Gas Analyst at GlobalData, comments: “The high-capacity addition of methanol in China is attributed to the fact that the country has abundant coal resources that facilitate the production of methanol through gasification. Moreover, methanol offers an ideal solution for China’s clean fuel demand and domestic energy development.”

Methanol serves as a vital precursor for manufacturing formaldehyde, acetic acid, MTBE, and other essential compounds that are extensively used in the construction and automotive sectors. As these sectors thrive in China due to its rapid industrialization and urbanization, the demand for methanol is also poised to increase.

To meet this growing demand for methanol, China is planning to expand its production capacity. As a result, the methanol supply in the country is projected to rise from 83.43 mtpa in 2023 to 94.89 mtpa in 2030.

In China, the major capacity addition is from Ningxia Baofeng Energy Group Yinchuan Methanol Plant 3, with a capacity of 2.34 mtpa. It is expected to start production of methanol in 2024. Sinopec Great Wall Energy Chemical Ordos Methanol Plant and Shenhua Baotou Coal Chemical Company Baotou Methanol Plant 2 follow next with capacities of 2.20 mtpa and 2 mtpa, respectively. They are expected to become operational by 2025 and 2026.