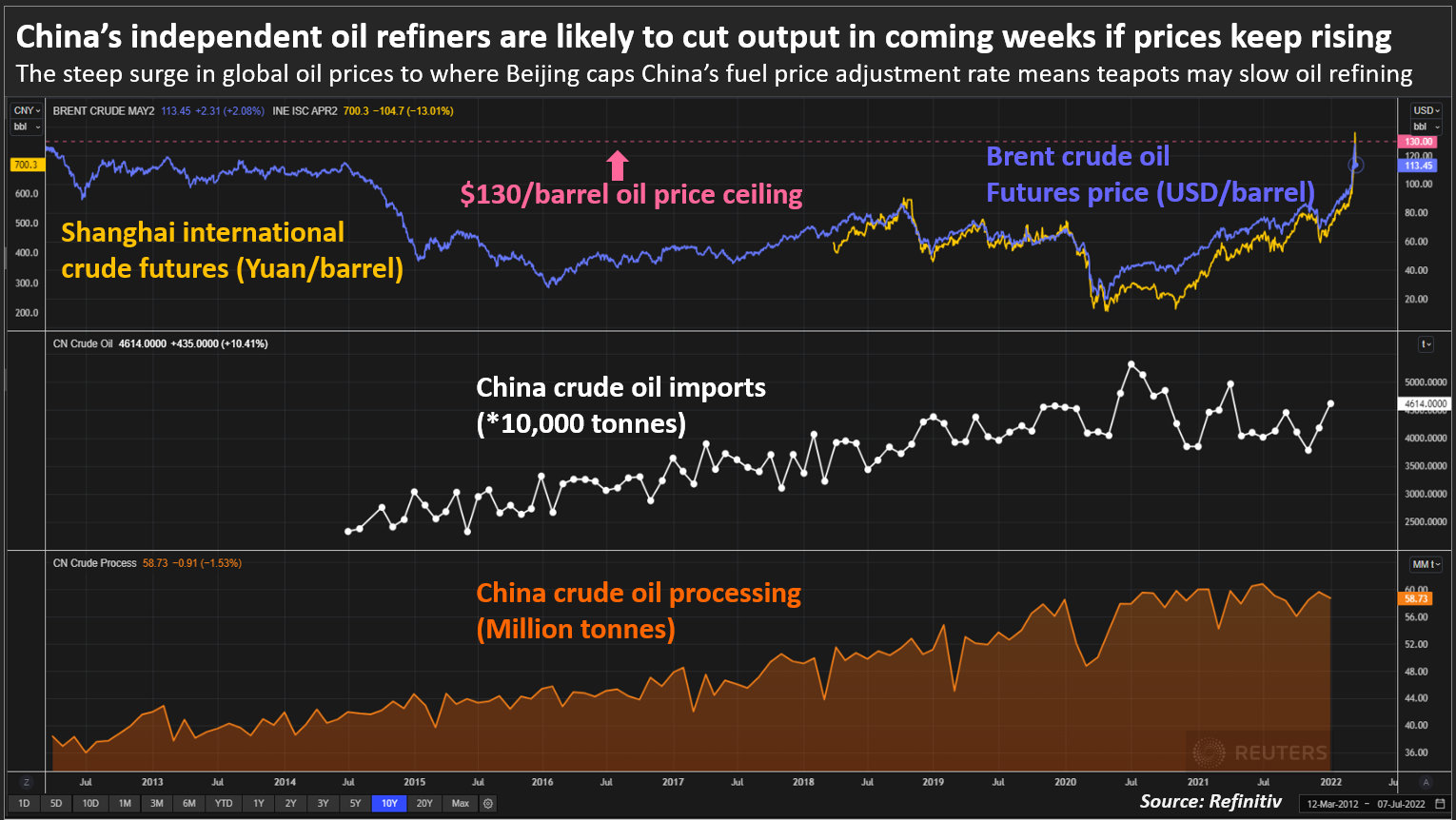

Singapore/Beijing —China‘s independent refiners are set to cut production in coming weeks as a Ukraine-driven surge in oil prices squeezes margins, with a jump over $130 a barrel unnerving producers, trading executives and analysts said.

Production curbs at the so-called teapot plants that account for a fifth of China’s crude oil imports will reduce purchases by the world’s top oil importer. In a sign of less buying, Beijing has already urged state refiners to halt gasoline and diesel exports in April to ensure domestic supplies.

The teapots, mostly located in eastern Shandong province, had already been expected to operate at lower rates this year after Beijing slashed their import quotas, but a spike in global oil prices to 14-year highs amid the Ukraine crisis is piling on pressure.

“Refining margins have rapidly thinned as the cost of imported crude oil soared much faster than domestic refined fuel prices,” Chinese commodities consultancy JLC said.

“If crude oil remains elevated, it’s possible to see more widespread production curbs or full plant closures for maintenance,” it added.

More than 40 independent refiners surveyed by JLC were operating at around 58% of capacity as of this week, against more than 70% during the same period last year.

Under a 2016 pricing scheme that largely links domestic pump prices to global crude, Beijing typically slows the frequency of price hikes on retail gasoline and diesel prices when crude rises above $80 a barrel, reducing margins for refiners.

At $130 a barrel for an undisclosed basket of oil benchmarks, a price touched by global oil benchmark Brent on Monday, the policy calls for a freeze on retail gasoline and diesel prices to help protect consumers.

Brent hit a high of $139.13 on Monday, but has since retreated to around $112.50, still up around 45% this year.

RUN CUTS

Teapots boosted purchases of discounted Iranian oil in early 2022 and have been able to use cash transfers to pay for Russian ESPO blend crude in recent weeks. read more .

However, plants have drastically reduced purchases of cargoes for April and May arrivals due to soaring crude and freight costs, said a Shanghai-based trading executive who procures crude for several teapots.

“It’s natural for a teapot to cut production and even fully halt operations when margins evaporate,” the executive said.

To avoid any refined fuel shortages, state refiners have been told to suspend or scale back gasoline and diesel exports in April.

Sinopec chairman Ma Yongsheng told state media this week that Asia’s top refiner has been maintaining “fairly high” operational rates.

“We are capable and determined to ensure oil product supply,” Ma said.

So far, there is little sign of a supply squeeze as Beijing’s rigid zero-COVID measures have discouraged long-distance driving.

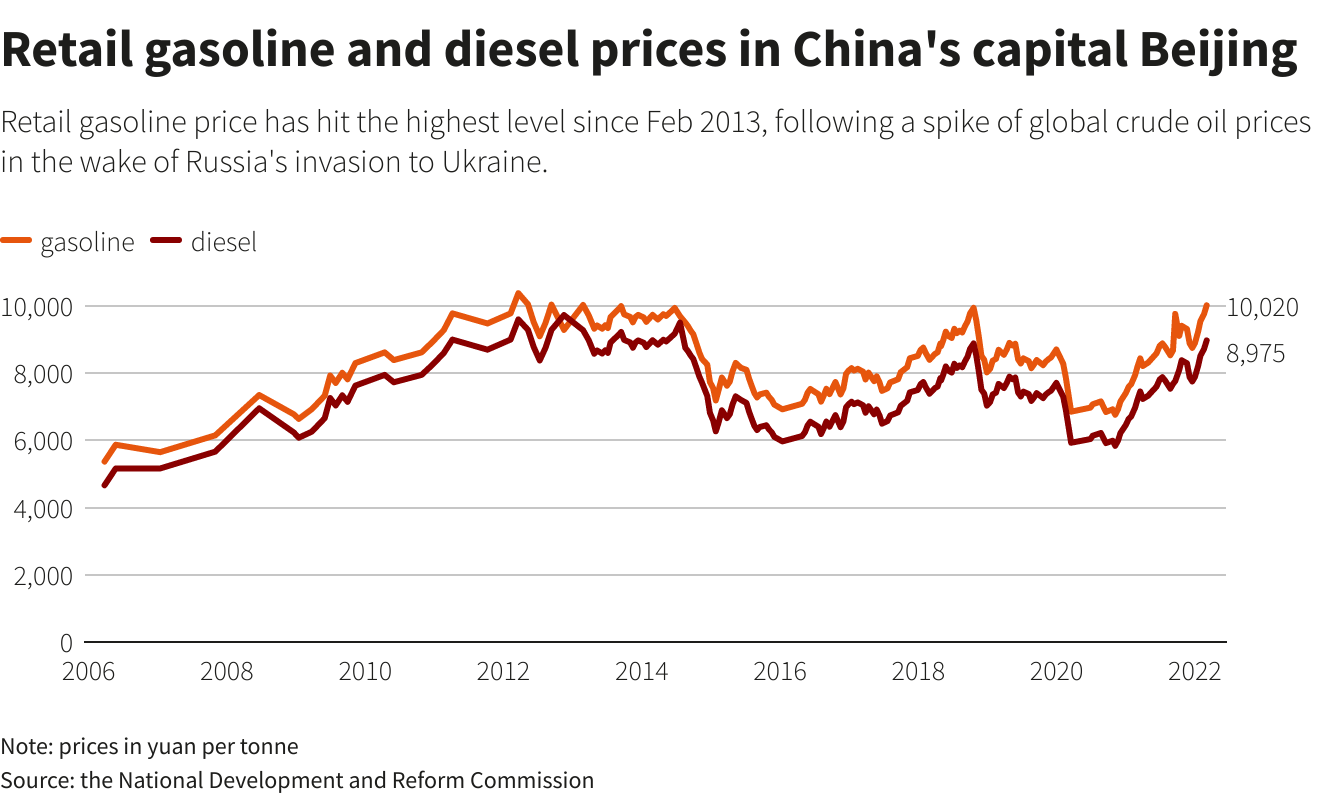

Consumers have also been feeling the pinch of near-record pump prices. Retail gasoline prices in the capital Beijing hit 8.56 yuan ($1.35) a litre this week, the highest since February 2013.

“We started seeing slowing petrol sales at our stations as early as when oil soared above $80,” said a source at an international major operating gas stations in China.

($1 = 6.3199 yuan)

*Chen Aizhu & Muyu Xu; Editing: Florence Tan & Richard Pullin – Reuters

Follow us on twitter