Houston, TX — Europe’s energy crunch kicked into overdrive last week.

That’s what a new BofA Global Research report sent to Rigzone this week stated, adding that TTF gas, French and German power prices spiked to new record highs.

“European energy markets reached a boiling point last week as gas and power prices soared to new levels of unaffordability,” the BofA Global Research report said.

“European energy markets reached a boiling point last week as gas and power prices soared to new levels of unaffordability,” the BofA Global Research report said.

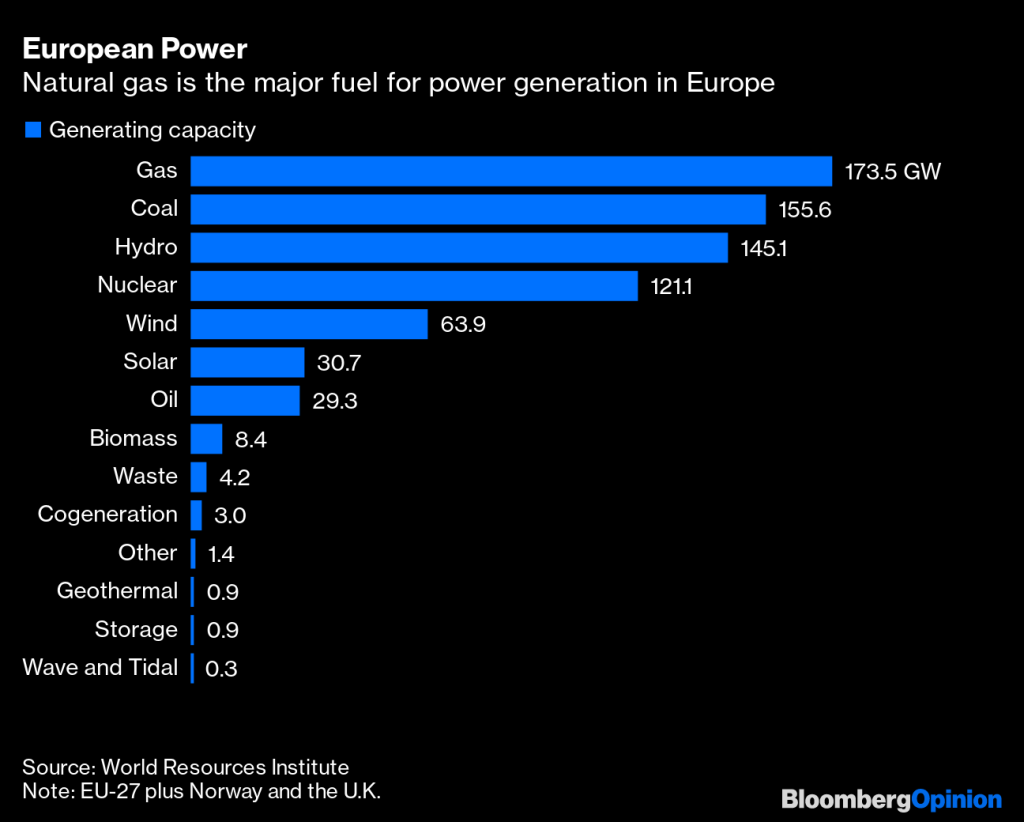

“The most recent leg higher in TTF and baseload power started with the announcement of more NS1 pipeline maintenance and concern that the outage may be longer than expected. Then, French nuclear generation slumped to new 10-year lows this week and EDF announced an extension of maintenance at several facilities that were already offline,” the report added.

“These factors helped drive TTF prices to a record EUR 340/MWh on Friday, or more than $550/barrel of oil equivalent. Meanwhile, French baseload power prices for Nov 22 – Feb 23 hit €1,800/MWh or about $3,000/boe, and CY2023 baseload power hit a record of €1,150/MWh, up from just €50/MWh at the beginning of 2021,” the BofA Global Research report continued.

In the report, BofA Global Research noted that demand destruction is needed and said current energy prices are untenable without government aid.

“Higher consumer prices are coming, with UK bills rising 80 percent in October,” the BofA Global Research report stated.

“Policy makers must do more but face a delicate balancing act. Raising bills too much may create unrest and worsen economic woes, while inadequate action could exacerbate the crisis,” the report added.

In a separate report sent to Rigzone last week, BofA Global Research highlighted that, ahead of a full shutdown of Nord Stream 1 this week, European gas curves continued to set records “as energy weaponization is priced in”.

“Last Friday [August 19], Gazprom announced that Nord Stream 1 will be closed for three days maintenance from August 31st to September 2nd. European TTF gas prices responded by setting fresh records – breaking through €300/MWh (>$500/boe or ~$90/mcf) as the market prices in heightened risk of further disruptions from the weaponization of Russian exports,” the BofA Global Research report stated.

“Notably, even future prices for the calendar year 2023 prices have shifted to >$280/MWh (far exceeding BofA’s base case €110/MWh forecast as well as our €225/MWh forecast under our ‘ugly’ scenario of flow disruptions),” the report added.

*Email andreas.exarheas@rigzone.com

Follow us on twitter