London — European industries’ ability to substitute natural gas with diesel and fuel oil to produce power is limited by high infrastructure costs and strict environmental regulations as the firms try to cut production costs amid high energy prices.

Europe has been facing an energy supply squeeze this year as Russia cut pipeline gas flows after the West imposed sanctions in response to its invasion of Ukraine in late February, leading to spiraling gas prices.

Industries such as glass producers, tyre makers and refineries have therefore been trying to switch to other fuels, even though they produce more carbon dioxide which is harmful for the environment.

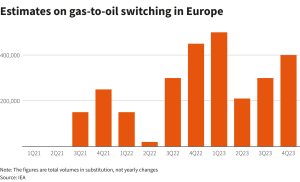

Surging oil use for power generation and gas-to-oil switching are lifting the growth trajectory for oil demand, according to the IEA.

IEA’s estimates, provided to Reuters, showed gas-to-oil switching was 300,000 barrels per day (bpd) in the third quarter of the year and could reach 450,000 bpd in the fourth quarter, both almost twice the amount in the same periods last year.

However, despite the economic advantages of burning oil instead of gas, volumes which can be switched remain limited due to strict environmental regulations and the high dependency of some industrial processes on gas, analysts said.

A switch to oil is not technically possible in all plants.

A switch to oil is not technically possible in all plants.

While some large gas plants have the ability to run combined heat and power (CHP) or back up electricity generators on diesel instead of gas, these are limited in number, according to the director of Energy Intensive Users Group, Arjan Geveke.

“Converting all facilities to run on alternative fuels is unlikely to be achieved before winter and comes at very large capital costs,” he added.

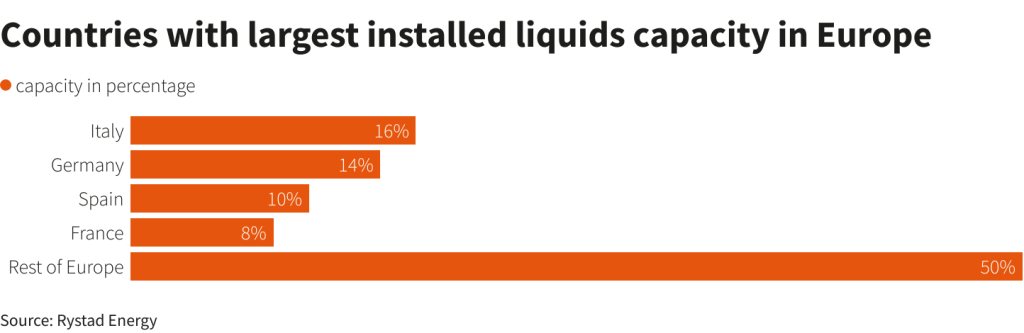

European industries’ capacity to switch from gas to liquid fuels is around 2 gigawatts (GW), or 2% of total installed capacity, according to Eurelectric, around 3% according to Rystad, and 5% according to FGE.

“Dedicated oil burning power generation capacity in Europe in use is low, as oil has been phased out practically in all European countries,” said Cuneyt Kazokoglu, director of energy economics at FGE.

Only about two decade ago, European fuel oil demand in power generation and industry sectors was in total above 1 million bpd, but it has consistently dropped to around 150,000 bpd in recent years, according to the FGE data.

The countries with the largest installed liquids capacity are Italy (16%), Germany (14%), Spain (10%), and France (8%), making up close to 50% of the total installed liquids capacity, according to Rystad Energy’s senior power analyst Fabian Rønningen.

European downstream firm Varo Energy told Reuters that its production has been affected by the high cost of gas and electricity, but it “has already changed its operations to minimize dependence on imported natural gas by switching to other fuels.”

Oil refiners Shell (SHEL.L) and Repsol also announced in July that they have has slashed gas intake in some of their refineries and have used alternative fuels. read more

Oil refiners Shell (SHEL.L) and Repsol also announced in July that they have has slashed gas intake in some of their refineries and have used alternative fuels. read more

France’s tyre-maker Michelin (MICP.PA) has converted its boilers so they’re capable of running both on gas or oil, while Germany’s biggest local utility Stadtwerke München (SWM) has reactivated previously shut oil burners at two heating plants. 1N2YR08S read more

*Bozorgmehr Sharafedin, Rowena Edwards; editing: Nina Chestney & Bernadette Baum – Reuters

Follow us on twitter