Accra, Ghana — Ghana’s central bank on Monday raised its main interest rate (GHCBIR=ECI) by 200 basis points to 19% to curb inflationary pressures and promote macroeconomic stability, Governor Ernest Addison said.

In March the Bank of Ghana raised its policy rate by 250 basis points to 17% – the largest hike in its history – to stem runaway inflation in one of West Africa’s more prosperous nations as the government cut spending to reduce the budget deficit and save a sliding local currency.

In March the Bank of Ghana raised its policy rate by 250 basis points to 17% – the largest hike in its history – to stem runaway inflation in one of West Africa’s more prosperous nations as the government cut spending to reduce the budget deficit and save a sliding local currency.

But in April the consumer inflation rate in the gold, oil and cocoa producer hit an 18-year high of 23.6%.

“The committee took the view that it needed to decisively address the current inflationary pressures to re-anchor expectations and help foster macroeconomic stability,” Addison told a press briefing in the capital Accra.

The rapid depreciation of Ghana’s cedi has slowed but the currency has still lost over a quarter of its value since the year began.

Capital outflows have entirely offset a $1.3 billion trade surplus gained from a 61% jump in crude oil export revenues in the first quarter.

Addison said that had created an overall balance of payments deficit of $934.5 million in the first quarter compared with $429.9 million in the same period last year.

Although the jump in April inflation was mainly driven by transport costs, prices rose for more than 96% of surveyed items, meaning most Ghanaians are feeling the pinch.

Central bank forecasts show a “prolonged horizon” for inflation to return to its target band, Addison said.

Finance Minister Ken Ofori-Atta had said another hike would be a “knee-jerk reaction” to mostly imported inflation, making it hard for the government to service its domestic debt.

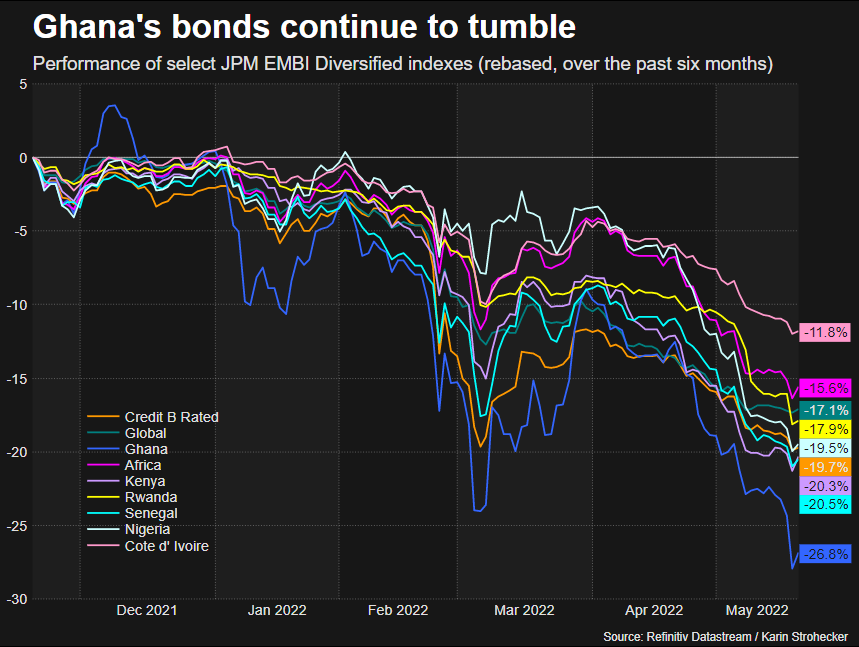

Addison said the total public debt stood around 78% of gross domestic product and that Ghana had been unable to access capital markets since Fitch and Moody’s both downgraded its sovereign credit rating earlier this year.

Although one analyst called Monday’s rate increase a “bold move”, it remains to be seen how broadly recent hikes will bolster investor confidence. Ghanaian benchmark bond yields have risen to 5-year highs since the beginning of May.

The benchmark 10-year treasury note yield rose to 25.913% on Monday, up from 24.625% at the end of last week.

“While there was at least a further tightening, by our calculations, the [real] policy rate is likely to remain negative for some time,” said Razia Khan, Standard Chartered’s chief economist for Africa and the Middle East.

*Christian Akorlie & Cooper Inveen; Rachel Savage; Editing: Sofia Christensen, Hugh Lawson & Emelia Sithole-Matarise – Reuters

Follow us on twitter