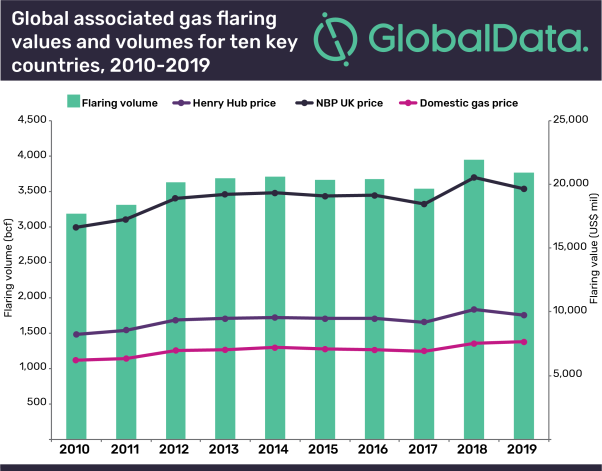

Lagos — Ten countries produced 80% of all flared gas, and their forgone revenue from failing to monetize the gas constituted over US$19bn in 2019, according to leading data and analytics company GlobalData.

Algeria, Angola, Indonesia, Iran, Iraq, Libya, Nigeria, Russia, the US and Venezuela represent the key global flarers of associated natural gas.

Anna Belova, Senior Oil and Gas Analyst at GlobalData, comments: “Gas flaring is not only a pollution issue, but also represents significant forgone revenues and economic loss.

Ten countries flared over 9.5 billion cubic feet of gas per day (bcfd) in 2019, which exceeded Germany’s demand for natural gas that year. The value of gas flared by top ten countries exceeds US$9.5bn, if priced at the US Henry Hub gas prices, and adds to $19bn if priced at the UK National Petroleum Board (NPB) prices.

Lack of access to markets and small volumes of gas produced at individual sites typify the main reasons behind significant flaring volumes globally. Low domestic gas prices in the US, Russia, Iran and Algeria further exacerbate the situation.

Belova adds: “The value of flared gas when priced at domestic prices is half of what the gas could command in European markets. Thus, export options must be considered for an economically feasible solution to flaring. For example, the flared gas from the Permian shale in the US will be ultimately destined for LNG exports once the midstream pipeline infrastructure increases in capacity to address the growth in gas production.

Belova concludes: “Flaring will not be easily resolved with one size fits all approach, given the regional drivers that necessitate flaring over monetization of gas. Rather a combination of regulatory pressures, technological innovations, and increased investments will allow countries to capture the forgone revenues.

“New technological solutions to monetizing flared gas at a well or field level aim to catalytically reform gas to liquid fuels or chemicals, with small-scale modular units, which can find application at remote shale and conventional oil projects. Stricter environmental regulations in Nigeria are responsible for recent reduction in country’s flared volumes, where gas is now being re-injected to increase oil recovery. Investments into midstream infrastructure in Russia allowed for associated gas from multiple oil fields to be processed into petrochemicals at large centralized plants.”