– Despite steady volume

Lagos — The global oil and gas contract activity saw a 35% quarter-on-quarter decrease in total disclosed value from $55.3 billion in Q2 2024 to $35.7 billion in Q3 2024. Despite this, steady contract volumes, particularly in the Middle East, were driven by substantial projects such as Saipem’s $4 billion contract with QatarEnergy and multi-billion-dollar agreements from Saudi Aramco, providing some stability, reveals GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Oil and Gas Industry Contracts Review by Sector, Region, Terrain and Top Contractors and Issuers, Q3 2024,” reveals that the overall contract volume remained relatively stable, with 1,519 contracts in Q3 2024 compared to 1,546 in Q2 2024.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “Contract activity in the Middle East has provided little stability, helping to offset the overall value decline. This is driven by Saipem’s $4 billion contract from QatarEnergy LNG for the North Field offshore compression program in Qatar and significant contracts worth over $3 billion from Saudi Aramco for Engineering, Procurement, Construction, and Installation (EPCI) work on the Zuluf, Safaniyah, and Marjan field development projects in Saudi Arabia.”

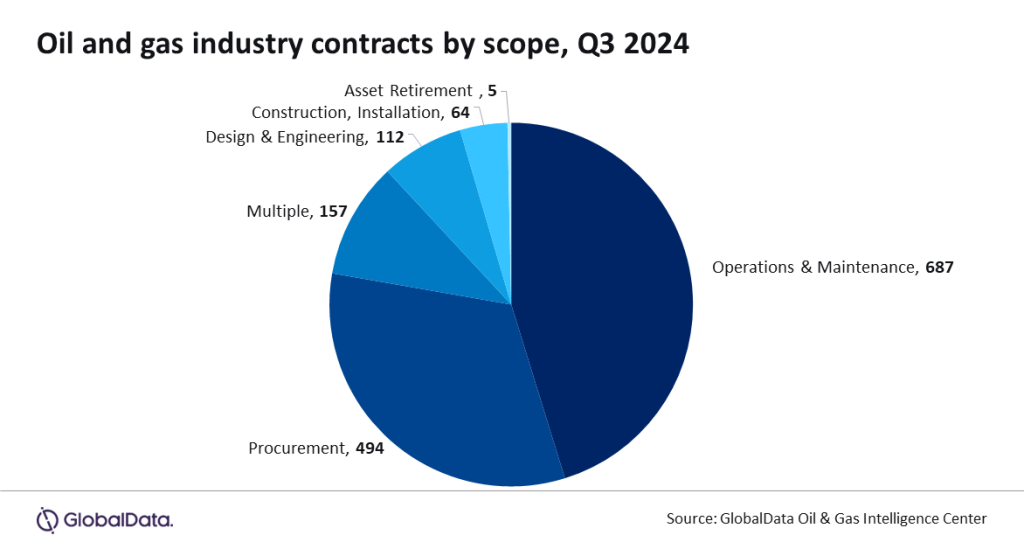

Operation and maintenance (O&M) represented 45% of the total contracts in Q3 2024, followed by procurement scope with 33%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 10%.

Some notable contracts awarded during Q3 2024 include Bechtel Energy’s approximately $4.3 billion lump-sum turnkey EPC contract for Train 4 and related infrastructure at the Rio Grande Liquefied Natural Gas (LNG) export project in the Port of Brownsville, Texas.

Saipem made significant contributions with several key contracts such as the $4 billion agreement with QatarEnergy LNG for the North Field offshore compression program in Qatar, covering engineering, procurement, fabrication, and installation of six platforms, along with 28-inch, approximately 100 km of corrosion-resistant alloy rigid subsea pipelines, 24-inch, 100 km subsea composite cables, 150 km of fiber optic cables, and various other subsea facilities as part of the COMP3A and COMP3B projects.

Additionally, Saipem secured a $2 billion contract from Saudi Aramco for the EPCI of wellhead platform topsides, jackets, tie-in platforms, rigid flowlines, submarine composite cables, and fiber optic cables for the Marjan field in Saudi Arabia, and further it received two contracts overall valued approximately $1 billion for the EPCI of jackets, production deck modules, subsea pipelines (both rigid and flexible), and subsea power cables for the Marjan, Zuluf, and Safaniyah fields in Saudi Arabia.

Kad concludes: “The surge in large-scale offshore and subsea projects, particularly in the Middle East, underscores the continued emphasis on expanding energy infrastructure to meet rising demand. As companies secure high-value contracts across key oilfields, the sector is not only reinforcing its strategic partnerships but also positioning itself to support long-term growth in energy production, with an increasing focus on sustainability and technological innovation in project execution.”