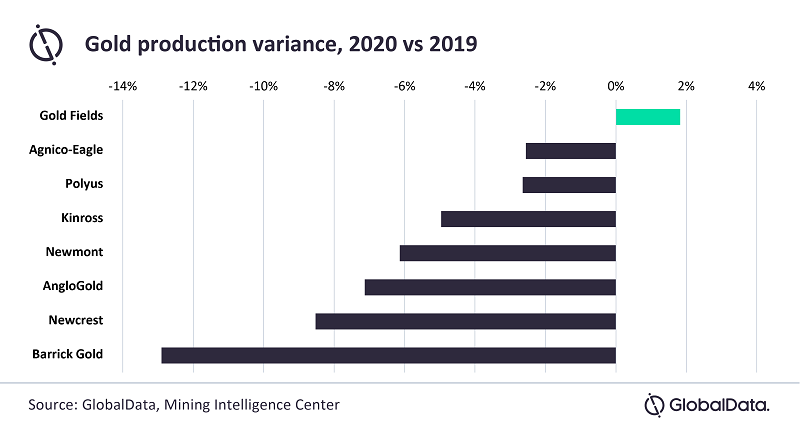

Lagos — Production from the world’s eight largest gold producers (Newmont, Barrick, AngloGold, Polyus, Kinross, Gold Fields, Newcrest and Agnico-Eagle) decreased by 6.5% to 25 million ounces (moz) in 2020 due to lower ore grades, sale of assets, lower mill throughput and lower recoveries.

Production from the top eight companies is expected to recover and will be between 25-25.75 moz in 2021, which is an increase of up to 3.1% compared with the collective output in 2020 (24.98moz), according to GlobalData, a leading data and analytics company.

Production from the top eight companies is expected to recover and will be between 25-25.75 moz in 2021, which is an increase of up to 3.1% compared with the collective output in 2020 (24.98moz), according to GlobalData, a leading data and analytics company.

The most significant falls in production were observed among the top three companies: Newmont (6.1%), Barrick (12.9%) and AngloGold (7.1%). The collective output from these companies declined to 13.7moz in 2020 from 15moz in 2019.

Vinneth Bajaj, Associate Project Manager at GlobalData, comments: “After a strong first quarter in 2020, Newmont’s production was impacted by lower ore grades at the Ahafo, Yanacocha and Merian mines and the temporary suspension of the Cerro Negro, Yanacocha, Eleonore, Penasquito and Musselwhite mines between March and mid-May. In addition, the sale of Red Lake and Kalgoorlie projects further reduced output.”

For Barrick, several gold mines were forced to cease operations temporarily due to the COVID-19 pandemic, including the Veladero, Pueblo Viejo and Porgera mines. Meanwhile, divestment of African assets by AngloGold was a major factor behind the fall in the company’s output in 2020.

Bajaj continues: “Lower ore grades, sale of assets, lower mill throughput and lower recoveries were key factors affecting production across the remaining major gold producers. For example, lower ore grades at Paracatu, Round Mountain and Chirano mines were behind the drop in production from Kinross, although it was partially offset by higher output from the company’s Bald Mountain and Kupol operations.”

Newcrest’s production was severely affected by the sale of Gosowong mine, which was acquired by Indotan Halmahera in Q2 2020. Lower throughput rates and lower grades at Cadia, Lihir, Red Chris, and Telfer mines, amid a series of planned shutdowns, also impacted the company’s production subsequently.