– if supply fails to meet demand

Lagos — Green energy technologies are in demand worldwide. Over 70 countries have set net-zero targets, and even more have pledged to lower their emissions. However, ambitious objectives to scale up green energy sources such as solar, wind, and nuclear are straining natural resources, particularly the minerals required to produce these essential technologies. With more than 50 million electric vehicles expected to be produced annually by 2035 and renewable electricity growth accelerating faster than ever, energy transition objectives risk being delayed if critical mineral supply cannot meet future demand, says GlobalData, a leading data and analytics company.

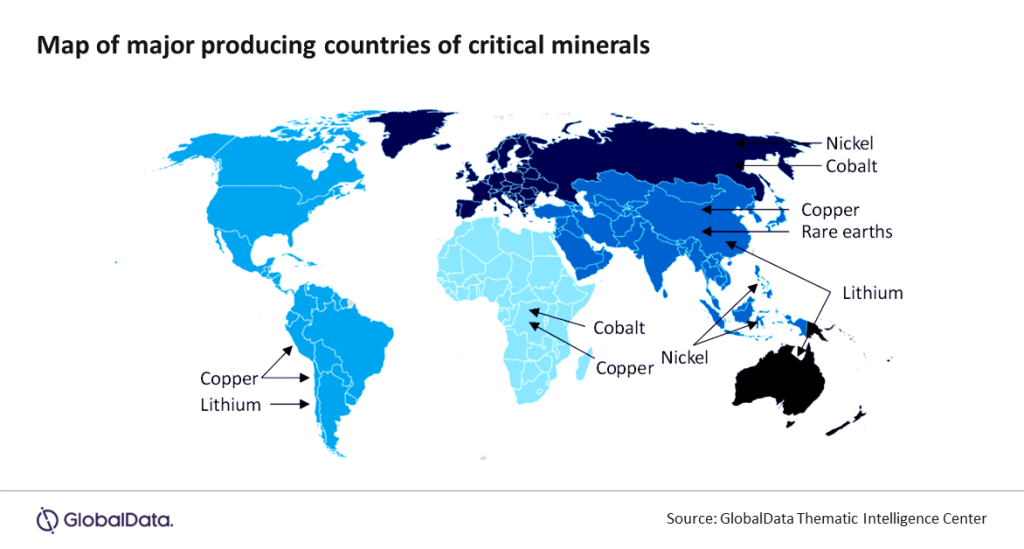

GlobalData’s latest thematic report, ‘Critical Minerals,’ identifies 15 minerals that are vital for the energy transition. Of these, the five most critical are lithium, cobalt, copper, nickel, and rare earth elements (REEs), which are imperative to the development of batteries for electric vehicles as well as solar, wind, nuclear, and hydrogen energy.

Isabel Al-Dhahir, Senior Analyst, Thematic Intelligence at GlobalData, comments: “Several minerals that are critical for the energy transition are facing various supply-side constraints. These include supply shortages, resource monopolization, and geopolitical impediments.”

Al-Dhahir continues: “Geopolitics is now at the center of the critical minerals’ discussion. The physical presence of many minerals is restricted to certain regions of the Earth, and China dominates the procurement and processing of many more. This has helped accelerate the development of China’s electric vehicle and energy transition industries. Following a delayed reaction, the US and the EU are eager to balance the scales.”

Deposits of critical minerals are typically found in specific regions of the world. For example, much of the world’s lithium reserves are concentrated in South America and Australia, the Democratic Republic of the Congo (DRC) provides much of the world’s cobalt, and Indonesia dominates nickel production.

Al-Dhahir concludes: “The race to control these mineral assets has led to intense rivalries between China, the US, and the EU, with China currently dominating the mineral supply chain and the development of energy transition technologies. To level the playing field, both the US and the EU have pledged hundreds of billions of dollars’ worth of financial support to their energy transition industries and the creation of independent mineral supply chains.”

Follow us on twitter