OpeOluwani Akintayo

Lagos — The resolution of the corporate crisis that has engulfed London-listed oil firm, Lekoil (Cayman) Limited, may take longer than anticipated, as Lekoil Nigeria legal redress over concerns on various degrees of alleged breach of processes by Lekoil Cayman.

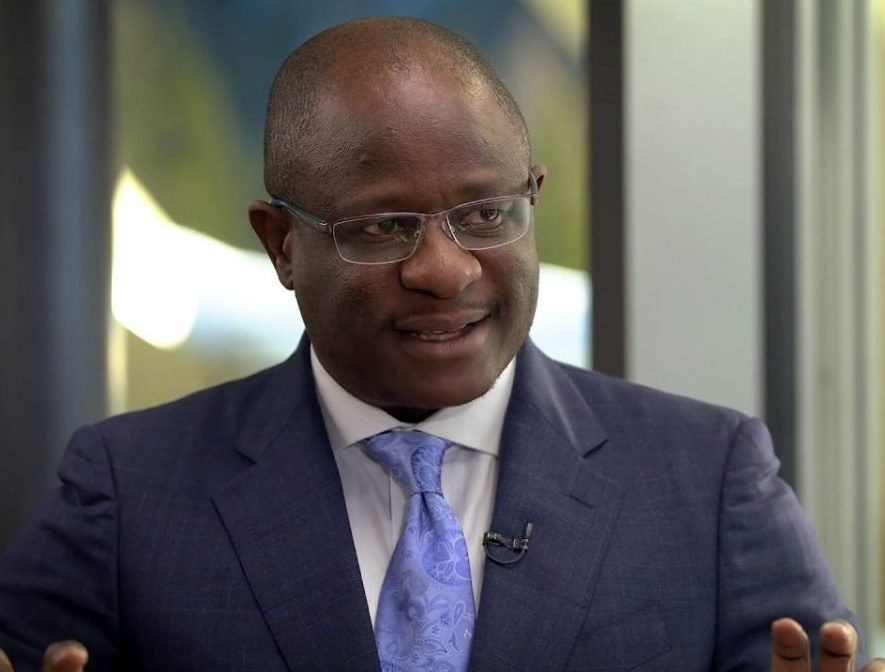

Lekoil Nigeria’s CEO, Lekan Akinyanmi, through his attorney, Proskauer Rose LLP, has finally sued Lekoil Cayman for unlawful and hostile takeover of the company, fueling speculation that even more interesting times lay ahead.

The takeover of Lekoil Cayman by Metallon largely accounts for the raging storm, after

Metallon bought the Lekoil Cayman shares on margin and having faced a margin call, was forced to sell.

Metallon, the majority shareholder of Lekoil Cayman, sold off its stake in London-listed Lekoil Ltd, driving down the value of the company’s shares 41 percent at £0.90 pence a few weeks ago.

Besides, Lekoil Cayman is yet to reveal the identity of the new buyers, the Board of Directors of Lekoil Cayman is also yet to be dissolved since August 30 when the news of the sale broke.

A group of concerned Lekoil shareholders have already protested the transaction, as the AIM rules stipulate that such volume of shares should be offered to the investing public.

The group is demanding full disclosure from Lekoil (Cayman) Ltd, as well as certain documents germane to the transaction including, copy of the TR1 filed by the purchaser of the Metallon Corporation shares, explanation as to the position of Metallon Corporation appointees, Thomas Richardson and Alphonso Tindall, copy of the Conditional Fee Agreement and detailed use of proceeds of the £200,000 amongst others.

The continued silence around the buyer of those shares sold by Metallon flouts AIM Rule 11 which by interpretation essentially requires an AIM Company to issue notification of new developments that are not public knowledge, but likely to affect the price of its AIM securities if made public, in the areas concerning its financial position, activities, business performance and expectations of performance.

This may explain why Lekoil Nigeria is filing a formal petition to the Alternative Investment Market, AIM, a sub-market of the London Stock Exchange, especially as Lekoil (Cayman) Ltd is seeking to raise a convertible facility agreement (CFA) worth £200,000 from Hadron Master Fund and TDR enterprises to fund its legal battle against Lekoil Nigeria.

Lekoil (Cayman) Ltd had fired its former CEO, Lekan Akinyanmi on alleged breach of corporate governance arising from a loan dispute, and has also said it intends to pursue the former CEO to recover the loan. The company is demanding that $800,000 is immediately payable, with $400,000 falling due on September 9, 2021.

Although Akinyanmi has challenged his ouster as unfair and has sued the company, Lekoil (Cayman) Limited is yet to publicly acknowledge this counterclaim.

In its announcement of 2 September 2021, Lekoil (Cayman) Limited indicated that it had entered into a Conditional Fee Arrangement with an unspecified law firm to seek to protect the assets of the Company (and presumably, recover the loan granted by the Company to the former CEO). No details of the terms of the Conditional Fee Arrangement were disclosed.

In an RNS announcement on 17 June 2021, Lekoil (Cayman) Ltd had informed the market that it would be publishing its annual results for the year ended 31 December 2020 not later than 30 September 2021, but failed.

The company’s former Finance Director, Mr. Edward During, had cited amongst other things, his disagreement with the need for an extension of the deadline for filing of accounts, the representations made to AIM Regulation to procure the extension, and the total disregard of his opinion with respect to the preparations of the statutory accounts.

Lekoil Cayman has admitted that it has limited control over the day-to-day operations of Lekoil Nigeria and its subsidiaries, but vows to take legal advice to recover as much value from its assets as possible.

It has also said; “The Company has received notification from Lekoil Nigeria that it intends to abide by the Shareholders Agreement but that governance decisions, including decisions related to budgets, financial, operational and business plans, shall be made by Lekoil Nigeria.”