– Naphtha selloff at the turn of the year helps to underpin ARA competitiveness, but wide E/W has cut off opportunities to the East.

London — 2025 has begun with some increasing signs that light-ends balances globally are quite long. This isn’t particularly surprising given the time of year and it is unlikely to be spooking many people about the health of the gasoline market in general moving into the rest of the year.

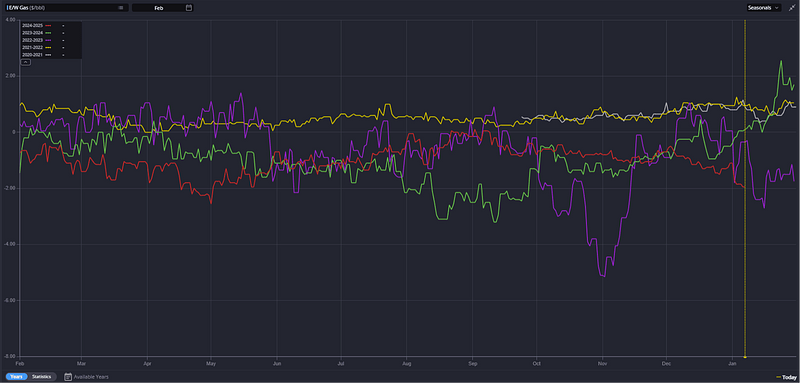

There are some interesting nuances, as well as inter-regional spreads to dig into as we kick off the year, however, starting with an ever-widening E/W that is moving to shut down further flows from Europe to the East of Suez.

As of now, whilst there are still some opportunities open into the East for January loading out of Europe (Kenya, for example), the vast majority of the opportunities we were referring to towards the end of last year have now disappeared.

The E/W has widened out to -$2/bbl, despite my assertions that it could/should narrow on a tighter EoS balance and the need for Europe to keep pushing out arb barrels, and that has been enough to counter weak freight rates and see swing importers in the East looking to Singapore instead.

Aside from alkylate and FCC gasoline, components in Singapore are not showing any great signs of strength at the moment and paper spreads are softening, suggesting this pull is yet to translate into a tightening of the pricing centre just yet.

In the Atlantic Basin, some very prompt RBOB opportunities aside, there is little to point to a particularly strong fundamental basis for ARA, and the underlying spreads are reflecting this.

A deeper contango is now likely to be absorbing a lot of the supply overhang that typically appears at this time of year, with outlets to WAF and Latin America still open to mop up the rest.

EBOB (E5 and E10) blend margins are slammed shut, even if the E10 premium over the swap has risen since the start of the year and has brought the blend margin back to more reasonable territory.

The most significant mover in the European gasoline market since the turn of the year has been the strong downtick in naphtha cracks, which has helped to support blending in ARA once again despite the relative strength of EBOB paper vs its counterparts both east and west.

European naphtha has followed moves in Asia lower and continues to overall appear reflective of a well-supplied European light ends market.

The same can not necessarily be said for the US market, however, where premia for reformate and toluene in particular remain very well supported.

These are the exception rather than the rule in Houston, but overall premia are higher in the US vs their historical averages than they are elsewhere at the moment, and this is reflecting in the relatively sparse set of arb options for USGC blenders currently.

The contango in RBOB has also widened in recent days, so we should expect a focus on stockbuilding through the coming weeks.

The US has exited 2024 only a couple of million barrels behind the 2017-19 average levels for total gasoline stocks. Looking forward through the typical build phase until mid-February now, we have ~15 million barrels to build over that period to start the draw season at those pre-Covid average levels.

However, we only have 10 million barrels before we move beyond the strong levels of 2023, for example. With limited outlets and strong runs and contango at the moment we may risk overshooting and weakening the Q2/Q3 outlook if we continue at current levels.