*As COVID-19 impacted deals

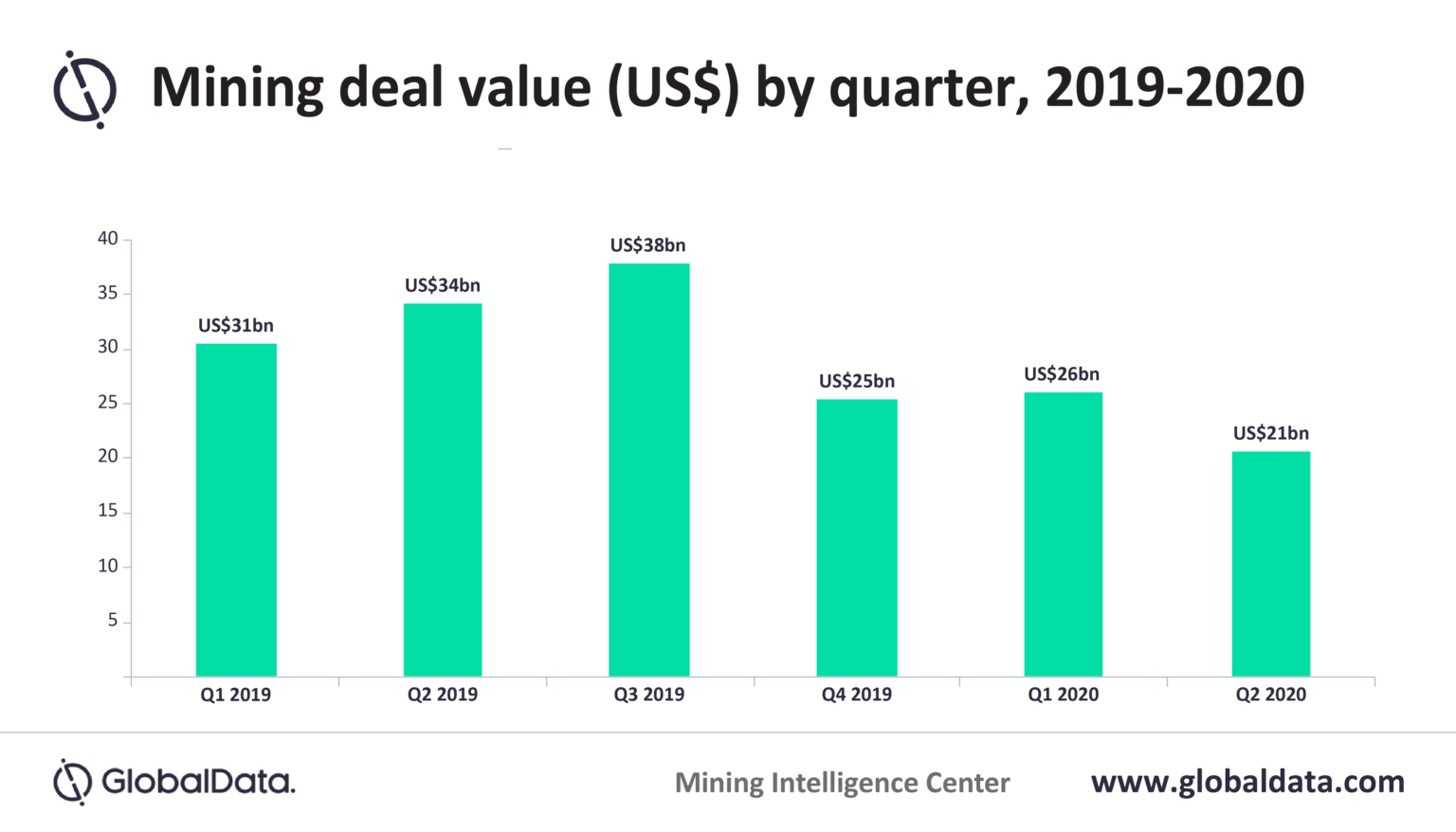

Lagos — After a flat first quarter of 2020, the total value of mining deals – including mergers and acquisitions (M&A), capital raising and asset transactions – declined by US$5.3bn to US$20.6bn in Q2 2020, according to GlobalData, a leading data and analytics company.

Vinneth Bajaj, Senior Mining Analyst at GlobalData, comments: “Mining M&A values dropped by 30.5% or US$2.9bn in Q2 2020, while there was a 24.8% or US$3.7bn drop in the capital raised by mining companies during the second quarter. The number of asset transactions, however, rose by 84.9%, with a US$1.3bn increase in value.”

The total volume of deals increased from 860 in Q1 2020 to 1,411 in Q2 2020 owing to an 84.9% increase in the total number of completed asset transaction deals in that quarter. This was accompanied by a 53.4% increase in the volume of completed capital raising deals. Canada, Australia, the US and the UK accounted for over 90% of the total deal volume and over 50% of the total deal value.

The largest of the completed deals was PT Indonesia Asahan Aluminium’s raising of US$2.5bn by offering three sets of bonds at 4.75% (due in 2025), 5.45% (due in 2030) and 5.8% (due in 2050). Of the total, 60% will be used to pay debts and to acquire 20% of PT Vale Indonesia, while the remaining 40% will be used to refinance the company’s older bonds.

Alongside that, Codelco raised US$800m in an offering of bonds due 2031 to refinance debt and enhance the company’s good liquidity position and improve its amortization profile over the medium term. The Chilean copper giant is operating mines with up to 60% workforce and maintaining production levels despite the company’s Chuquicamata smelter remaining suspended.

Additionally, Newcrest raised a collective US$788m, out of which US$653m was used to fund the purchase of Fruta del Norte Financing facilities in Ecuador and the remainder to fund developments at its Red Chris operations in Canada and Haverion project in Western Australia.

Bajaj adds: “Eight of the top ten asset transactions deals involved gold. Topping the list was Mudrick Capital Acquisition Corporation (MUDS), which acquired an equity interest and assets from Hycroft Mining Corporation for a consideration of US$537m to form Hycroft Mining Holding Corporation.”