News Wire — The U.S. Energy Information Administration (EIA) has kept its Brent spot price averages for 2021 and 2022 flat in its latest short term energy outlook (STEO).

News Wire — The U.S. Energy Information Administration (EIA) has kept its Brent spot price averages for 2021 and 2022 flat in its latest short term energy outlook (STEO).

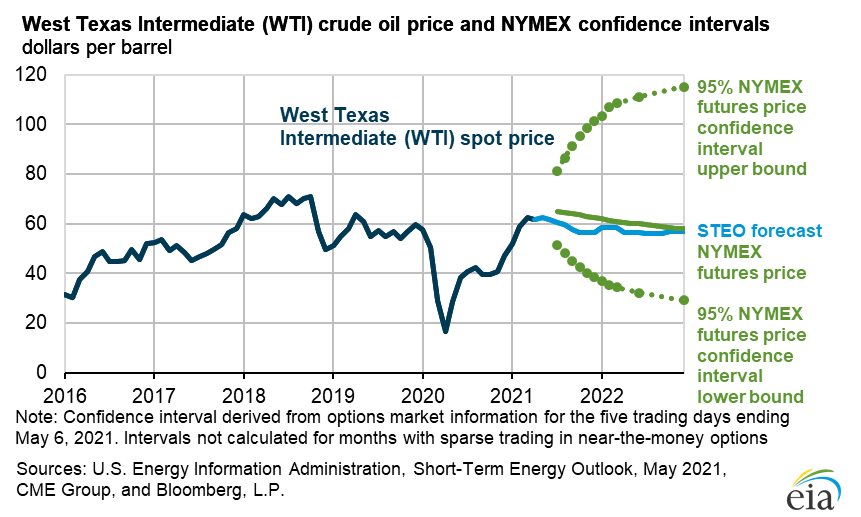

The EIA forecasts that Brent will average $62.26 per barrel this year and $60.74 per barrel next year in in its May STEO. In April, the organization forecasted that Brent would average $62.28 per barrel and $60.49 per barrel in 2021 and 2022, respectively.

In its May STEO, the EIA highlighted that Brent crude oil spot prices averaged $65 per barrel in April, which it noted was unchanged from the average in March. The company expects Brent prices will average $65 per barrel in the second quarter of 2021 and $61 per barrel during the second half of 2021.

“Brent prices were steady in April as market participants considered diverging trends in global Covid-19 cases,” the EIA stated in its May STEO.

“In some regions, notably the United States, oil demand is rising as both Covid-19 vaccination rates and economic activity increase. In other regions, notably India, oil demand is declining because of a sharp rise in Covid-19 cases,” the organization added.

The EIA estimates that the world consumed 96.2 million barrels per day of petroleum and liquid fuels in April, which it noted is an increase of 15.8 million barrels per day from April 2020, but four million barrels per day less than April 2019 levels. The organization forecasts that global consumption of petroleum and liquid fuels will average 97.7 million barrels per day for all of 2021, which it noted is a 5.4 million barrel per day increase from 2020.

According to the EIA’s most recent data, the U.S. crude oil production averaged 9.9 million barrels per day in February this year. This was said to be down by 1.2 million barrels per day from January. Cold temperatures caused significant declines in crude oil production in Texas, as well as smaller declines in other states, the EIA noted. The organization estimates that production rose to 10.9 million barrels per day in March and to almost 11 million barrels per day in April.

The EIA warned that its May STEO remains subject to heightened levels of uncertainty because responses to Covid-19 continue to evolve. It also said it completed modeling and analysis for its latest report before the temporary closure of the Colonial Pipeline on May 7 as a result of a cyberattack.

*Andreas Exarheas – Rigzone