Abuja/Lagos — ExxonMobil’s Nigerian petroleum assets sale to Nigeria’s Seplat could be approved in less than two weeks, the country’s oil regulator told Reuters on Thursday.

The $1.28 billion sale in Africa’s largest oil exporter has awaited regulator approval since 2022.

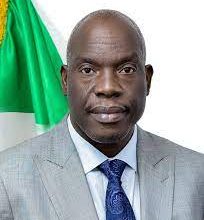

Gbenga Komolafe, chief executive of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), told Reuters the parties involved would be invited to a meeting on Friday.

“Subject to the outcome of the meeting, consent…could be given in less than two weeks from the date of the meeting,” he said.

NUPRC would give the companies two mutually exclusive options that, if accepted, would permit approval of the deal, he said.

He did not spell out what these options were but said the law requires money to be set aside for decommissioning, host community development and environmental remediation.

“As a commission, we don’t want our nation to carry unwarranted financial burdens arising from the operations of the assets over time by the divesting entities.”

A spokesperson for Seplat declined to comment. An Exxon spokesperson did not immediately comment.

Observers say approving the deal would bring much needed investment into Nigeria’s petroleum sector. While it is pending, there is little incentive to put money into the assets, which means production will gradually decline.

Former Nigerian president Muhammadu Buhari initially consented to the transaction, but withdrew that consent days later after the oil regulator refused to sign off on it.

President Bola Tinubu, who took office last year, has made attracting investment a key priority.

*Camillus Eboh & Isaac Annyaogu; Libby George; editing: Peter Graff & Jason Neely – Reuters