Oscarline Onwuemenyi

07 April 2017, Sweetcrude, Abuja – Nigeria’s Federal Executive Council has approved a $1.3bn loan credit facility for the commencement of the Development Bank of Nigeria.

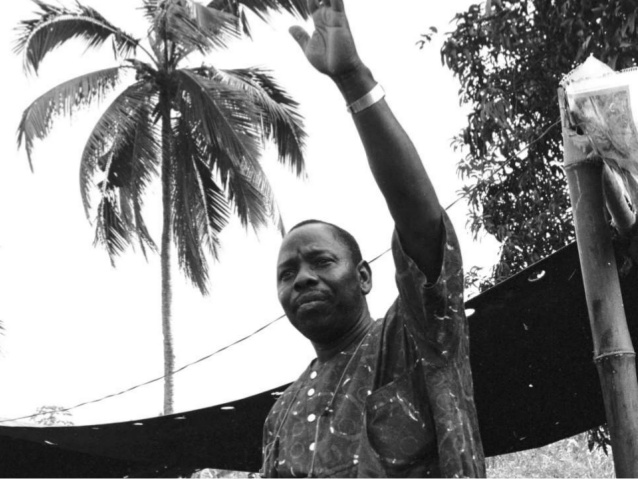

The approval came on the heels of a memo submitted by the Finance Minister, Mrs. Kemi Adeosun seeking council’s ratification on the loan’s request.

Adeosun, who briefed State House correspondents on the outcome of FEC meeting which was presided over by President Muhammadu Buhari, said $500m of the amount would come from the World Bank.

According to the minister, another $450m is expected from the African Development Bank, and $200m from KFW, a financial corporation.

Adeosun said another $130m would come from the French Development Agency to make up the $1.3bn earmarked for the commencement of the bank.

“As you know, the Development Bank of Nigeria recently received its licence and is being funded by some long-term loans from some of our development partners. So the World Bank had given us $500m repayable over 21 years and all of this is at a concessional rate.

“The African Development Bank is giving us $450m and KFW is giving us $200m and the French Development Agency are giving us $130m.”

She added that “To access this money, we are ready to disburse but there are two requirements that we need to make and one of them is the legal opinion by the Attorney-General of the Federation and the other is the National Assembly approval.

“Before it goes to the National Assembly, it needs to be approved by FEC and the FEC simply approved today that these loan requests should go to the National Assembly for approval.

“So we can access this money and the Development Bank of Nigeria can take off fully as it is expected to transform Financing of our MSMEs sector.”

The minister said, “The council enthusiastically approved these facilities which are on long term, meaning that the DBN will be able to lend to our MSMEs over much longer periods and at much lower rates. So the impact on the SMEs will be quite considerable.”

According to her, the loans are also concessionary with interest rates of less than two percent and have a very long repayment period of up to 21 years.

The loans are aimed at allowing the bank to lend to Small and Medium Enterprises for a longer period with interest rate lower than in commercial banks.

Adeosun also said that the council approved N550 million contracts to hire project managers and verification consultants for the integration of the military’s payroll into the Integrated Payroll and Personnel Information System (IPPIS).

She said that 200,000 military personnel would be integrated into IPPIS.