Abuja — Nigeria plans to set up the Nigerian Solid Minerals Corporation, a state-backed company to help attract investments into the extraction of gold, coal, iron-ore, bitumen, lead, limestone and baryte, a minister said on Sunday.

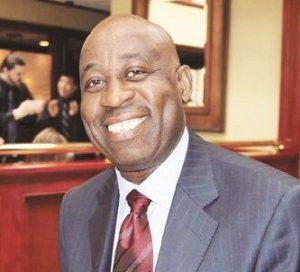

“The proposed corporation will seek and secure partnership investment agreements with big multinational companies worldwide to leverage on the attractive investment-friendly regime operating in the country to secure massive foreign direct investment for the mining sector,” Solid Minerals Minister Dele Alake said in a statement.

Nigeria wants mining to play a much bigger role in its economy by expanding its mineral extraction sector to diversify away from an overreliance on oil exploration.

Alake did not give a timeframe for when the new company would be set up. Existing enterprises – the National Iron-Ore Company and the Bitumen Concessioning Programme – will be reviewed to fit into the new company while a mines police force will be active from October to detect illegal mining, he said.

President Bola Tinubu has embarked on the country’s boldest reforms in decades to try to improve Nigeria’s investment climate and draw foreign investors to Africa’s biggest economy.

Tinubu inherited a struggling economy with record debt, shortages of foreign exchange and fuel, a weak naira currency, inflation at a near two-decade high, skeletal power supplies and falling oil production due to years of underinvestment, crude-oil theft and pipeline vandalism.

His administration has said it will seek to promote investments rather than rely on borrowing to create jobs.

Tinubu plans to attend the forthcoming G20 summit to promote foreign investment in Nigeria and mobilize global capital to develop infrastructure.

The new corporation will engage local financial institutions, which have shied away from the mining sector in the past due to a long gestation period for projects, to promote investment, Alake said.

*Camillus Eboh, Chijioke Ohuocha; Editing: Susan Fenton – Reuters

Follow us on twitter