Lagos — The overall oil and gas industry’s disclosed contract value witnessed a significant quarter-on-quarter (QoQ) increase of 60% in Q2 2023, mainly driven by a mega contract for Qatar’s North Field South (NFS) LNG project, reveals GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Oil and Gas Industry Contracts Analytics by Sector (Upstream, Midstream and Downstream), Region, Planned and Awarded Contracts and Top Contractors, Q1 2023,” shows that the overall contract value increased from $35.4 billion in Q1 2023 to $56.7 billion in Q2 2023. However, the contract volume was unable to keep up the pace and saw a decrease from 1,625 in Q1 2023 to 1,256 in Q2 2023.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “The big boost on the value front is attributed to Technip Energies and Consolidated Contractors Company (CCC) joint venture’s landmark $10 billion engineering, procurement, construction and commissioning (EPCC) contract to build 16 million tonnes per year North Field South (NFS) LNG project in Qatar.”

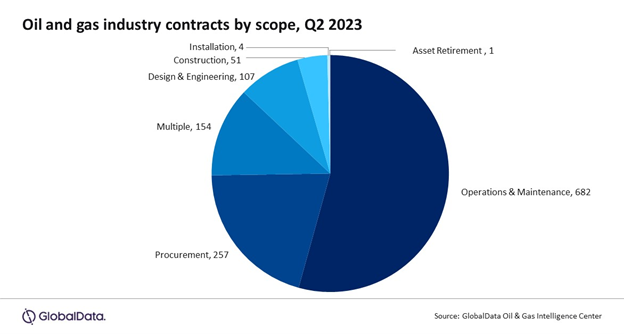

Operation and Maintenance (O&M) represented 54% of the total contracts in Q2 2023, followed by procurement scope with 18%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for 11%.

Some of the other notable contracts during the quarter include Hyundai E&C’s two lump-sum turn-key contracts combined worth approximately $5 billion from Saudi Aramco and TotalEnergies, covering the detailed design EPC for a mixed feed cracker (MFC), and utilities, flares, and interconnecting facilities at the Amiral petrochemicals facility expansion in Jubail Industrial City, Saudi Arabia.

Maire Tecnimont subsidiaries also secured two lump-sum turn-key contracts worth around $2 billion from Saudi Aramco and TotalEnergies for the EPC of derivatives units and high-density polyethylene (HDPE) units for the Amiral expansion.