– Saudi, Russia to dictate prices over the next 3 months – analyst

– Saudi, Russia to dictate prices over the next 3 months – analyst

– US shale, Iran and Venezuela oil production to ease tightness

– For a table of crude price forecasts, click

Bengaluru — Saudi and Russian supply cuts are expected to keep feeding into stronger oil prices, but any runs towards the $100 a barrel level are likely to be short-lived as economic risks linger, a Reuters poll showed on Friday.

A survey of 42 economists and analysts forecast Brent crude , currently holding just above $95 a barrel, would average $84.09 a barrel in 2023, up from August’s $82.45 consensus.

Brent, which has averaged around $81.94 so far this year, is projected to average $86.45 in 2024.

U.S. crude is seen averaging $79.64 a barrel this year – above last month’s $77.83 forecast – and $82.99 a barrel in 2024.

“Saudi Arabia and Russia will dictate oil prices over the next three months,” said Bill Weatherburn, commodities economist at Capital Economics.

“Supply cuts will probably be extended into 2024 as neither country wants prices to fall while they are grappling with higher government expenditures.”

Oil prices are expected to stay well above $80 a barrel heading into next year, with Brent seen averaging $89.85 in the last quarter of 2023, the poll showed.

The much touted $100 a barrel oil looks stretched however “given the artificial nature of supply shortages in the system, and the fragile macro environment”, Suvro Sarkar, energy sector team lead at DBS Bank, said.

Some analysts expect production increases through U.S. shale to help offset the OPEC+ supply cuts, albeit only marginally. Rising output from Iran and Venezuela is also seen helping.

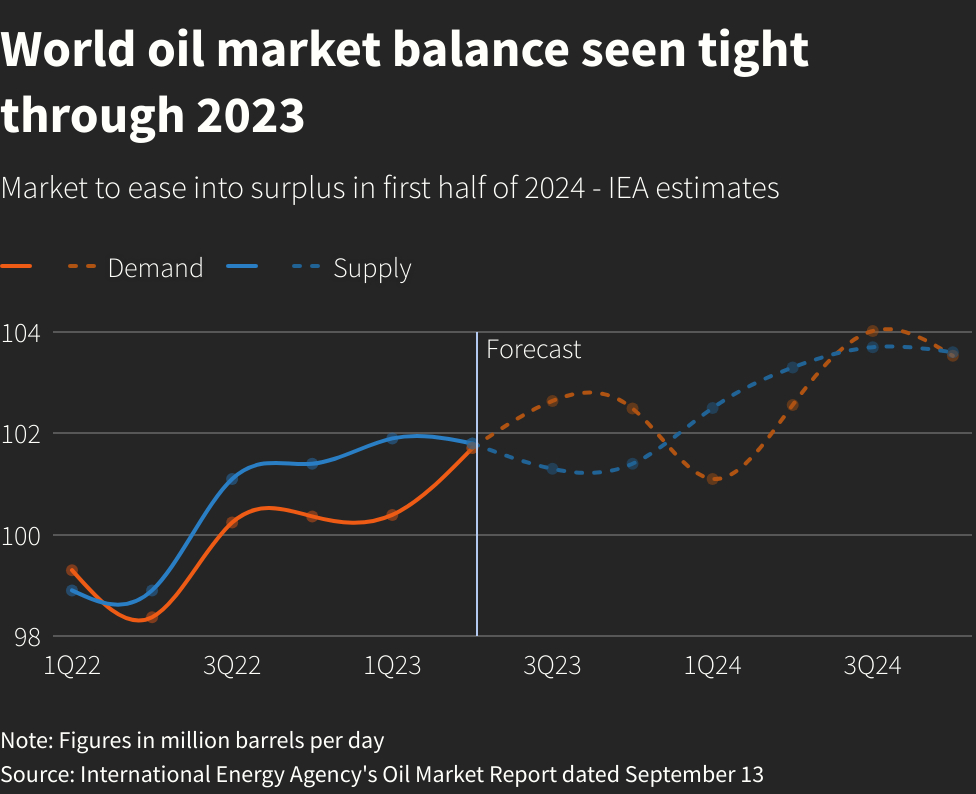

The International Energy Agency (IEA) expects the market to remain in deficit through 2023, with oil demand seen rising by 1 million barrels per day in 2024.

However, a lack of output cuts at the start of next year could shift the balance to a surplus.

Robert Yawger, energy futures strategist for Mizuho Bank, said higher global rates may tip the global economy into a recession in 2024, impeding oil demand along with concerns over the Chinese economy.

*Harshit Verma; Swati Verma; editing: Arpan Varghese & Jan Harvey – Reuters