Lagos — The COVID-19 pandemic has had a significant impact on the oil and gas industry, leading to a decline in demand and a drop in oil prices.

However, the industry has been recovering since then, with oil prices gradually increasing and demand for energy returning to pre-pandemic levels.

Consequently, the overall oil and gas industry contract value seen a significant quarter-on-quarter (QoQ) increase of 27% in Q4 2022, reveals GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Oil and Gas Industry Contracts Analytics by Sector (Upstream, Midstream and Downstream), Region, Planned and Awarded Contracts and Top Contractors, Q4 2022,” shows that the overall contract value increased from $47.38 billion in Q3 2022 to $60.36 billion in Q4 2022. Contract volume, however, decreased from 1,673 in Q3 2022 to 1,443 in Q4 2022.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “The key drivers for the value momentum were Saipem’s $4.5 billion contract from Qatargas for the engineering, procurement, and construction (EPC) of the North Field Production Sustainability Natural Gas Compression Complex Project, offshore north-east coast of Qatar; and ADNOC’s $4 billion framework with ADNOC Drilling, Schlumberger, and Haliburton for the integrated drilling fluids services (IDFS) for projects in the UAE.”

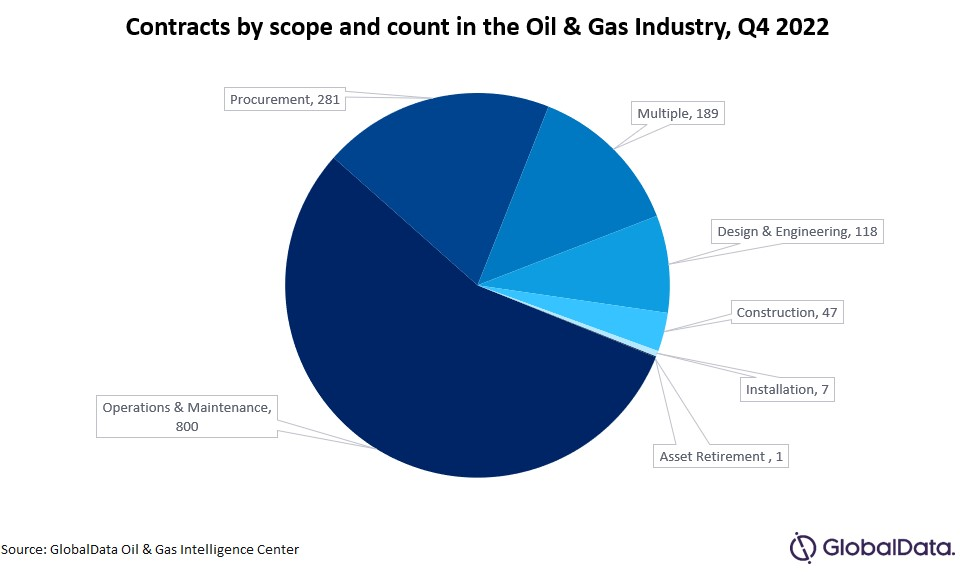

Operations and maintenance (O&M) represented 55% of the total contracts in Q4 2022, followed by procurement with 19%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for 13%.

The other notable contracts include Sembcorp Marine’s $3.05 billion contract from Petrobras for the EPC of Floating Production, Storage, and Offloading (FPSO)- P-82 vessel to be deployed on the Buzios field in the pre-salt Santos basin, Brazil; and JGC Holdings, and Samsung Heavy Industries (SHI) consortium’s contract estimated between $2 – $3 billion from Petronas for the Engineering, Procurement, Construction, and Commissioning (EPCC) of nearshore Floating Liquefied Natural Gas (FLNG) plant with an expected capacity of 2 million tonnes per annum (mtpa) in Sabah, Malaysia.

Follow us on twitter