Ike Amos

16 November 2017, Sweetcrude, Abuja — Indigenous oil and gas firm, Seven Energy Plc, Wednesday, entered into a lock-up agreement with a United Kingdom-based energy company, Savannah Petroleum Plc, for the sale of its assets in Nigeria.

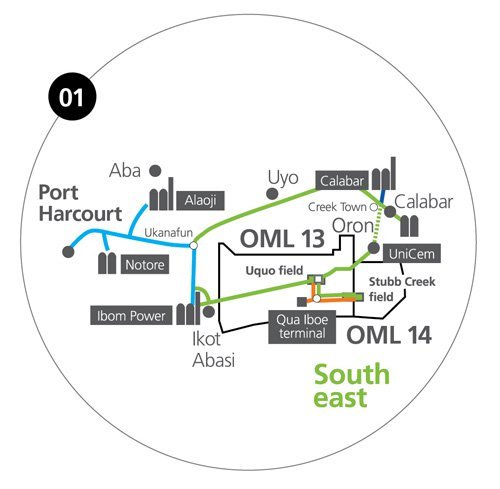

The transaction, according to a statement by the UK company, would see Savannah take a 40 percent interest in the Uquo oil and gas field in Nigeria and a 63 percent interest in Seven Energy’s subsidiary, Universal Energy Resources Limited, which has a 51 percent interest in the Stubb Creek oil and gas field in the south-east Niger Delta.

Savannah also stated that it had also agreed to provide Seven Energy with a super senior revolving credit facility of up to $20 million.

Savannah Petroleum said it would take an unspecified interest in the Accugas Limited midstream business, an approximate 260-kilometre gas pipeline network and associated gas processing infrastructure, potentially alongside third-party investors.

A lock-up agreement is a legally binding contract between the underwriters and insiders of a company prohibiting these individuals from selling any shares of stock for a specified period of time. Lock-up periods typically last 180 days but can on occasion last for as little as 120 days or as long as 365 days.

The agreement, the statement said, envisaged a consideration of $87.5 million in cash and $52.5 million in newly issued Savannah shares, adding that this would be paid to the holders of Seven’s current 10 percent senior secured notes.

Speaking on the deal, Chief Executive of Savannah Petroleum, Andrew Knott said, “We are pleased to have reached this milestone in the agreed transaction with the signature of the lock-up agreement, which represents the culmination of many months of hard work by Savannah, Seven, its stakeholders and the respective advisory teams.

“The work relating to Savannah’s admission document remains ongoing and we look forward to providing more detailed updates in the coming weeks.”

In addition, Savannah said, the holders will have the right to participate in a $20 million new capital contribution, a new $25.0 million Savannah share issue, and a new $20 million facility issued at the Accugas level.

Savannah said the transaction will proceed on the assumption that Seven Energy will not be able to reinstate the strategic alliance agreement signed in 2010 between subsidiary Seven Exploration & Production Limited, and Nigerian Petroleum Development Company, NPDC, relating to several Nigerian projects.

The company said implementation of the transaction will take around four to five months allowed for Savannah to raise the necessary equity, shareholder agreement, sanction of the schemes, and approval from regulatory and government authorities.