Using VesselsValue data, Rebecca Galanopoulos Jones, Senior Content Analyst, analyses the current trends in the Tanker and Bulker markets.

Lagos — Values for five year old VLCCs (Very Large Crude Carriers) are currently at the highest levels since 2009. For example, 320,000 DWT, 5YO are currently valued at USD 95.74 mil, up 33.12% from the start of the year from USD 71.92 mil in January. Overall, Tanker sales have risen this year by c.12% with 1,026 transactions reported so far in 2022.

Uptick in values comes as the Tanker spot market continues to gain ground, with VLCC’s currently earning 79,833 USD/Day on the TD3C-TCE Middle East Gulf to China route. This has been the highest level since April 2020, up by almost 78,000 USD/Day from the same period last year. Such levels are due to changes in trade flow patterns and additional tonne mile demand (stemming from impending sanctions on Russian oil coming into force next month), Additionally, these surges are due to demand from Europe looking to secure energy, as winter in the Northern hemisphere approaches.

Notable sales include the Elandra Everest (300,000 DWT, January 2020, Hyundai HI) sold to Al Seer Marine for USD 107.5 mil, VV value USD 105.33 mil.

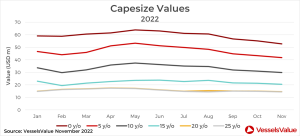

Capesize values tumble since the start of 2022

Values for Bulkers have fallen across all size and age ranges since the start of the year. In the Capesize sector, values for five year old vessels have fallen by c.7% since January from USD 45.86 mil to USD 42.6 mil. Despite this fall, values still remain above average levels, indicating that values could continue to correct lower if earnings remain under pressure. The drop in values corresponds to an overall downward trend in earnings, as declining iron ore demand from China has hampered the current earnings potential for this sector.

Capesize spot earnings continue to be outperformed by the smaller sizes with the Baltic Exchange 54-TCA currently at 12,807 USD/Day down c.59% year on year. Capesize sales for November are up considerably from last year, where just one sale was reported in November 2021. The number of transactions has already outpaced October levels, with six sales reported so far, up 20% from last month, implying that owners are potentially seeing opportunities in the current levels for secondhand values.

Recent sales include the Capesize True Patriot (180,600 DWT, March 2016, Imabari) that sold earlier this month for USD 40 mil, VV value USD 40.13 mil. The Navios Obeliks (181,400 DWT, June 2012, Koyo Dock) sold earlier this month to Seaenergy Maritime of Greece for USD 29.5 mil, VV value USD 31.47 mil, also the HL Shinboryeong (179,300 DWT, May 2010, Hyundai Samho) sold to Brave Maritime of Greece for USD 24.8 mil, VV value USD 26.65 mil.

About VesselsValue

VesselsValue Ltd. (VV) is a leading online valuation and market intelligence provider for the Aviation and Maritime industries. VV went live in 2011 and has 2,500 users and works with over 500 global companies including major banks, leasing companies, shipowners, investment funds, hedge funds, lawyers, advisors and government regulators. The company has nine offices globally including London, Singapore, Shanghai, Hong Kong, and Oslo, with over 220 employees.

VesselsValue’s mission is to bring transparency and objectivity to the Aviation and Maritime markets through a wide range of services. Data and market insights are available through online access, reports, API feeds and exports, including automated values, transactions and fleet data, as well as AIS and ADS-B derived mapping & tracking, demand, utilisation and trade and people flows.

Follow us on twitter