1 November 2011, Sweetcrude, Lagos – It is no longer news that the Federal Government has developed cold feet over going ahead with the planned removal of petroleum subsidy, which will herald the full commencement of deregulation of the downstream petroleum sector.

Government’s indecision follows mounting criticisms against the plan, which many believe would increase the hardship of the common man. This is because if allowed to run, the price of petrol would be as high as N140/ per litre, while kerosene, the fuel for the common man will be as high as N155/L, according to the latest market data on the Petroleum Products Pricing Regulatory Agency, PPPRA’s website.

Both petrol and kerosene are currently enjoying subsidy, which put their retail prices at N65/L and N50/L respectively.

By removing subsidy, government said it would be saving about N1.3 trillion per annum, which it plans to use to shore up other sectors of the economy, such as infrastructure provisions particularly for effective downstream operations.

As shown in the table above, between 2006 and 2011, the Federal Government of Nigeria has spent in excess of N3.56 trillion, a huge burden that has weighed heavily on its finances in view of numerous needs.

Apart from being a huge resource drain, the subsidy regime is open to corruption, with the Minister of Petroleum Resources, Mrs Diezani Alison-Madueke, admitting that checking marketers’ sharp practices had become intractable.

According to her, rather than the masses benefiting from the system as originally intended, “the majority of the subsidies were actually going to the middle line operators.”

Against this backdrop she added, “It has become pertinent that we find other ways to utilize vast resources that are being channelled into subsidy, which are not reaching the masses.”

Going forward, she said government would set up an advisory body or a think tank, “who would monitor and advise,” as government would not handle the implementation of these benefits.

How prepared are stakeholders for deregulation?

As the arguments go back and forth on the wisdom of the subsidy removal, many believe that the downstream sector is not fully prepared, infrastructure-wise for deregulation.

For instance, what are the states of the refineries, can the Nigerian National Petroleum Corporation, NNPC, the operators of the four refineries cope with the fuel needs of Nigerians?

As the arguments go back and forth on the wisdom of the subsidy removal, many believe that the downstream sector is not fully prepared, infrastructure-wise for deregulation.

For instance, what are the states of the refineries, can the Nigerian National Petroleum Corporation, NNPC, the operators of the four refineries cope with the fuel needs of Nigerians?

If not, can the Federal Government cope with continuous products importation and the attendant capital flight and attendant offshore jobs creation associated with it?

In terms of infrastructures are petroleum marketers – majors or independents or depot operators fully prepared for the challenges of deregulation in terms of depot and storage facilities, jetties and a

host of others?

host of others?

Are the regulatory authorities – the Department of Petroleum Resources, DPR and the PPPRA fully equipped to enforce market discipline, and check sharp practices, so that consumers do not suffer

unduly on account of operators’ recklessness?

unduly on account of operators’ recklessness?

These unanswered questions make market analysts believe that government is putting the cart before the horse, as these issues should have been dispensed with before announcing the intent to

deregulate.

deregulate.

Current demand/supply reality

Local Refining – the existing four refineries have combined capacity of 445,000 barrels per day, bpd. Over the past five years the refineries only contributed between 4% and 20% to the national PMS/petrol consumption, according to PPPR calculations.

Local Refining – the existing four refineries have combined capacity of 445,000 barrels per day, bpd. Over the past five years the refineries only contributed between 4% and 20% to the national PMS/petrol consumption, according to PPPR calculations.

Products Importation – the tempo of importation activities have increased due to lack of local refining capacity and the guaranteed cost recovery for importers through the Subsidy Scheme, PSF.

National Consumption – there has been a noticeable increase in the national consumption of petroleum products. PMS national daily consumption for example currently stands at 35 million litres from the initially observed 30 million litres, and Kerosene 8million litres up from 6 million litres in previous years respectively.

NNPC embarks on refineries rehabilitation

The NNPC enjoys monopoly on refining in Nigeria, as it is the operator of the nation’s existing refineries. However, in view of current realities, the corporation is not deriving maximum benefits from its monopoly status, as it should because of the very poor state of the refineries.

The NNPC enjoys monopoly on refining in Nigeria, as it is the operator of the nation’s existing refineries. However, in view of current realities, the corporation is not deriving maximum benefits from its monopoly status, as it should because of the very poor state of the refineries.

NNPC’s Group Executive Director, Refining and Petrochemicals, Mr. Phil Chukwu, in a no-holds-barred interview with Sweetcrude, is the first to admit that NNPC cannot cope and compete effectively under the current state of the refineries.

He said, “The question has been asked that can we survive deregulation. And the answer is that the way we are today, no! For us to survive we must look at how can we make the refineries efficient.”

Chukwu disclosed that the search for efficiency plunged the NNPC into a rehabilitation programme that will revamp, maintain and prepare the refineries for possible future capacity expansion.

The rehabilitation programme is expected to last for a couple of years, because according him, it goes beyond mere turn round maintenance, TAM, a routine structure that the refineries have not

enjoyed for decades.

enjoyed for decades.

He explained, “Although we have invested, we’ve done some turn around maintenance, but you find that these are usually very far in between.

Instead of doing them in three year cycles, we wait till sometimes 10 years and more. So, many things have happened and what we are trying to do today is to look at the problems from different angles. We look at the plant itself, the different ones I have mentioned, we also look at the supply chain because crude comes from the fields and tank farms into the refineries. They go through pipelines and all that and when the petroleum products are produced, they also go through pipelines into depots, tank farms or hauled by road to where they are needed. These are all areas we must look at.

“Then the third bit of the problem is the people. How have we been operating these refineries, do we have the necessary skills to achieve the objectives of these refineries. So we look at the plants, we look at the supply chain and then we look at the people. So, in our rehabilitation efforts, we are going to address these three key elements.

“For us to survive, we must move away from our current production levels of 60% and the fact that some of the units downstream are not functioning very effectively, so we must fix them. In fixing them, it is not a one-day thing, it is something that must be planned properly – gathering data, doing feasibility studies, scoping, doing the design and all and at the end of the day you are guaranteed the time when you finish and you are also guaranteed your costs. But if you don’t do it very well, you are bound to mid-way start to go here and there, trying to solve problems that should have been solved before you started.”

Regulators perspectives

Downstream regulators in the DPR were weary to comment on the planned deregulation when contacted severally by Sweetcrude, but its PPPRA counterpart had a whole lot of arguments in favour of deregulation.

According to the PPPRA, “Deregulation and price liberalization of the downstream oil sector constitutes the basis for medium to long term reforms within the downstream petroleum sector.”

This, it noted, will to introduce competition, enhance efficiency, and improve products supply, just as appropriate and liberalised pricing framework will help reduce inefficiencies in sourcing, refining,

marketing, supply and distribution of petroleum products.

marketing, supply and distribution of petroleum products.

It further argued that “the elimination or reduction of unsustainable subsidy burden on government and allow deployment of resources to fund critical infrastructure and vital social sector spending is critical to revamping the sector.”

It also said that a deregulated sector will facilitate the operation and management of pipelines and storage facilities under the Open Access, Common Carrier regime.

Notwithstanding its numerous advantages, the PPPRA was quick to note that “Deregulation/liberalisation must be accompanied by infrastructural development, institutional and regulatory reforms,” to encourage prospective investors.

Some of the areas begging for infrastructure upgrade in the downstream the PPPRA enumerated include, adequate import reception facility, which it said will reduce the demurrage exposure experienced in products handling.

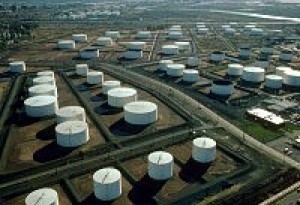

• Investment in storage facility and network of pipelines as we move through the creation of a National Strategic Fuel Reserves (NSFR)

• The existing pipelines need to be refurbished and adequately maintained.

• There is no pipeline network in the North West region. Could be an opportunity for investment

• Also, developing surveillance system of the pipeline network in view of the incessant pipeline vandalism.

• The existing pipelines need to be refurbished and adequately maintained.

• There is no pipeline network in the North West region. Could be an opportunity for investment

• Also, developing surveillance system of the pipeline network in view of the incessant pipeline vandalism.

Marketers also keep mum

None of the representatives of the various marketing groups were willing to speak on their level of preparedness for deregulation and challenges ahead. The Major Marketers Association of Nigeria, MOMAN; Independent Petroleum Marketers Association of Nigeria, IPMAN; Depot and Petroleum Products Marketers Association, DPPMA; and the Jetty and Petroleum Tanker Farm Operators of Nigeria, JEPTFON, all had nothing to say.

But under the condition of anonymity, a DAPPMA member insisted that deregulation is the only way forward, adding that the only issue at stake is, “the sincerity of government to pull it through because we have been on the process for over 10 years now.”

He noted that the only reason why deregulation has suddenly become a big issue is because “government is cash-strapped, and because of increasing pressure from state governments for increase in allocation in the light of the new minimum wage, government is trying to save from every possible way.”

He argued that his members have invested heavily in storage facilities and were waiting to get on with the process and begin to reap the dividends from their investments.

But most marketers of the petroleum products marketers had borrowed from the banks at very high interest rates to finance their projects and may not start making profits anytime soon. With the clamp down on administrative recklessness by the Central Bank of Nigeria, CBN, banks are under pressure to recover their loans.

Moreover, with the acquisition and takeover of some of the distressed banks by new management and some with international affiliations, the fear of these downstream facilities being placed under receivership has heightened.

In the face of these challenges, government may well continue the burden of subsidy longer than expected, except it takes the drastic step of full blown deregulation after certain structures have been put in place.