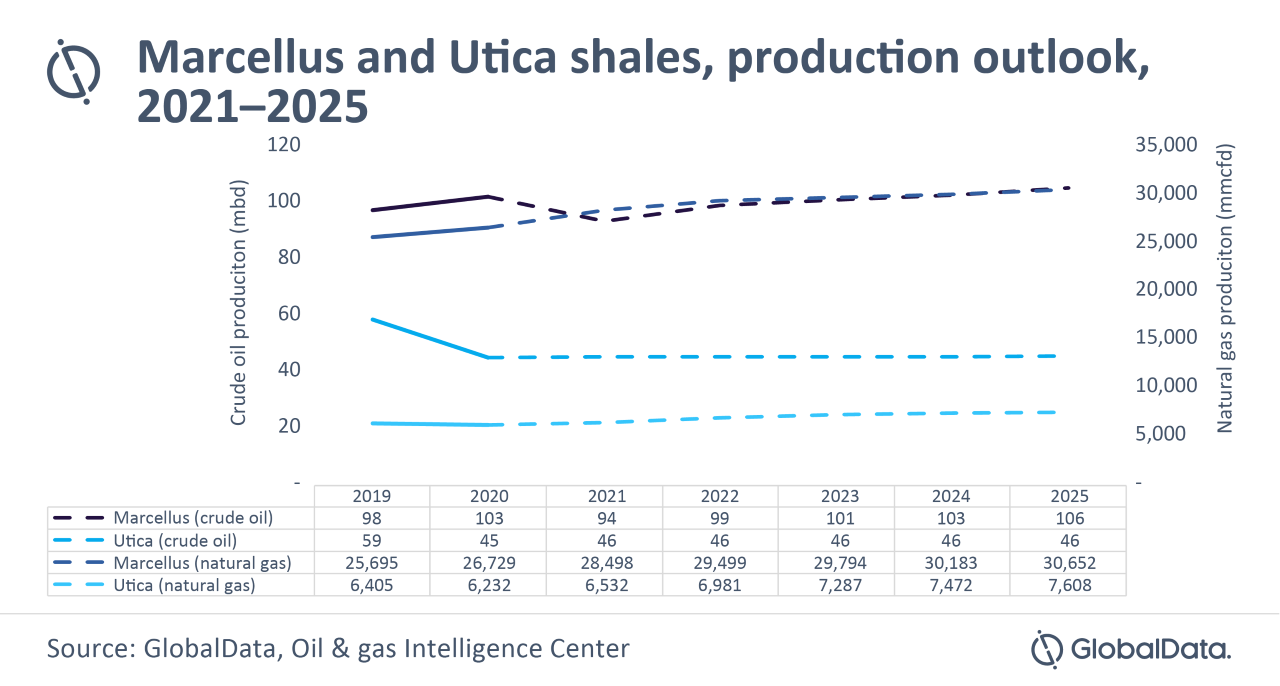

Lagos — As natural gas appraisal and development processes in the US’s Marcellus and Utica shales were largely unaffected by COVID-19, natural gas production at these sites is expected to rise at a compound annual growth rate (CAGR) of 5.1% to reach a combined 38.3 billion cubic feet per day by 2025, according to GlobalData, a leading data and analytics company.

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “Not only did natural gas appraisal and development evade some of the more devastating impacts COVD-19 had on other areas of the oil and gas industry, but natural gas production in these shales exceeded pre-pandemic levels in 2021, reaching 35 bcfd on an annual basis. In fact, Marcellus and Utica accounted for nearly one-third of the total natural gas production in the US. ”

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “Not only did natural gas appraisal and development evade some of the more devastating impacts COVD-19 had on other areas of the oil and gas industry, but natural gas production in these shales exceeded pre-pandemic levels in 2021, reaching 35 bcfd on an annual basis. In fact, Marcellus and Utica accounted for nearly one-third of the total natural gas production in the US. ”

According to GlobalData’s latest report, ‘Marcellus and Utica Shales in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025’, the Marcellus and Utica shale plays saw an increase in natural gas production in Q4 2020 and January 2021 before leveling out during Q1 and Q2, 2021. In July 2021, there was a slight increase to almost 29 billion cubic feet per day (bcfd).

Doh continued: “In 2020, with the crash in oil prices, operators saw massive reductions in capital expenditures and headcounts. The US shale industry also witnessed record numbers of bankruptcies and debt restructurings. Operators continue to recover from this downturn. As a result, deal activity in the Marcellus and Utica shales is still below pre-pandemic levels.”

The total merger and acquisition (M&A) deal value in these shales is up just 1% over 2020, and down approximately 5% from 2019 through three quarters.

Doh added: “M&A activity in other crude oil plays in the US was mainly related to the consolidation tactic of bigger oil and gas companies holding assets across multiple plays. However, Appalachia is the biggest natural gas play in the US, and deals occur mainly for medium-to-small sized operators within a handful of gas plays in the country, resulting in a smaller total deal value.”

Crude oil production in the Marcellus shale is expected to reach pre-pandemic levels in 2022 and increase further to 2025, while crude oil production in the Utica shale is unlikely to recover by 2025.