Lagos — As the number of cases rise and business sentiment tumbles, Sub-Saharan Africa is likely to see a slowdown in upstream activity for ongoing projects and final investment decisions (FIDs) anticipated in 2020, according to GlobalData, a leading data and analytics company.

Conor Ward, Oil & Gas analyst at GlobalData comments “With global crude oil prices currently hovering around the US$30 per barrel mark and cases of COVID-19 on the rise daily, companies have been forced to rethink project timelines for 2020 and operators are beginning to scale back spending in the short-term as they struggle to source adequate capital.”

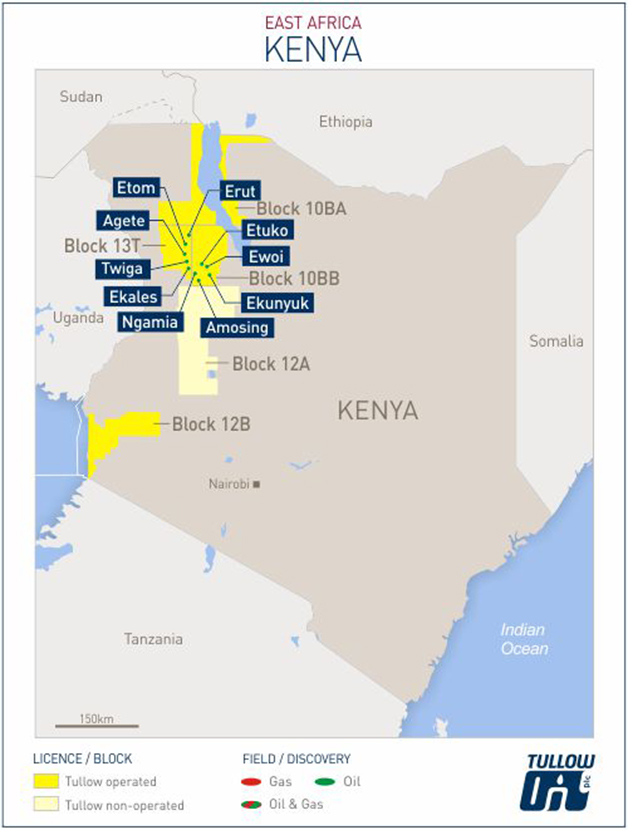

Major capital intensive projects in the region such as the liquefied natural gas (LNG) mega projects in Mozambique, as well as the projects in Uganda and Kenya were to be the first in their respective countries. However, they have faced multiple delays in the past and are looking likely to continue to face further delays considering the current economic climate.

Ward continues: “The breakeven oil and gas prices of the majority of projects with anticipated FID for 2020 are now considered as high risk. The most capitally intensive project in the region is the Mamba complex in Mozambique, and with ExxonMobil as the operator – who is expected to reduce capex by approximately 20% – it is likely that this project will be unable to secure an FID in 2020.”

The fall in oil prices will have large implications upon the oil and gas industry of Sub-Saharan Africa as only extremely efficient and robust projects that can survive in a low-oil-price environment, or can be sheltered from external market factors, will be able to go ahead this year.

Ward continues: “Projects that are already under construction with investment finalised will contractually have to go ahead, however, will likely face disruption to their timescales. This will be particularly pertinent for landlocked countries that require external supply chains often deriving from shipyards or supply bases in China or Asia-Pacific where the outbreak of COVID-19 began.”

The Sub-Saharan Africa region, and in particular Nigeria where the regulator has just asked for an offshore workforce restriction, will see a reduction in production and investment in the near term as new project investment suffers amid declines in legacy producing fields.

Ward concludes: “The outlook for oil and gas projects for Sub-Saharan Africa in 2020 is bleak as major producing countries in the region (Nigeria and Angola) suffer with production declines and the wave of east coast LNG projects facing defferal until 2021 or later.”