Kampala — Uganda said it would borrow up to 108.5 million euros ($118.42 million) from a Chinese lender to fund construction of three roads that are key to plans to begin oil production in the east African country.

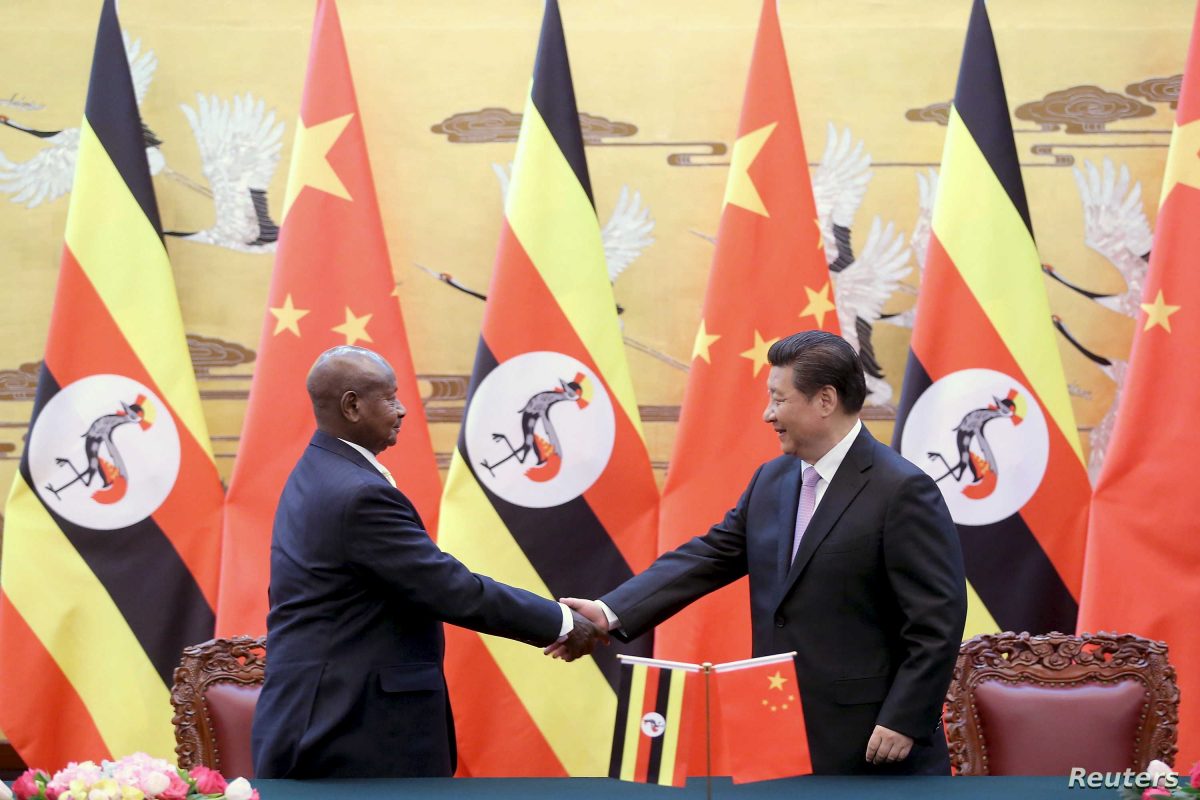

Along with others in Africa, Uganda has received large credit lines from China in recent years as part of the Asian giant’s so-called Belt and Road Initiative, aimed at rebuilding the old Silk Road connection with Asia, Europe and beyond.

However U.S. officials have been critical of Belt and Road lending, which they say can leave countries with excessive debt.

Construction of the so-called oil roads would accelerate efforts to commence crude oil production in Uganda, which has failed to take off 14 years after crude reserves were discovered in the country’s west.

The money will be borrowed from China’s Industrial and Commercial Bank of China, according to a statement issued by the government that listed decisions taken at a cabinet meeting on Monday.

The statement said the roads are needed to “facilitate the efficient development and production of the strategic national oil resources”. It did not give details on the total length of roads to be built.

Uganda’s oil fields are in the Albertine rift basin near the border with the Democratic Republic of Congo. Reserves are estimated at 6 billion barrels.

France’s Total co-owns the fields in equal stakes with China’s CNOOC and UK’s Tullow Oil.

Crude production has been repeatedly delayed over the years by spats over taxes and a lack of requisite infrastructure like tarmac roads in the fields, a crude export pipeline and a refinery.

A new impasse over taxes on Tullow’s planned divestment of part of its stake in the fields is seen as potentially pushing the production target of 2022 to a later date.

Last week the IMF cut its economic growth projection for Uganda for the July 2019 to June 2020 financial year, citing tardy progress with oil production.

The Washington, DC-based institution also warned Ugandan authorities to exercise fiscal discipline and maintain debt sustainability.

Uganda’s public debt, the IMF calculates, is expected to hit the key benchmark of 50% of GDP as early as the 2021/22 financial year.

$1 = 0.9163 euros Reporting by Elias Biryabarema; Editing by George Obulutsa and Jan Harvey.

*Hydrocarbon Processing