Lagos — Using VesselsValue data, Vivek Srivastava, Senior Trade Analyst, explores the rise in global gas prices amidst the unfolding events between Russia and Ukraine.

Lagos — Using VesselsValue data, Vivek Srivastava, Senior Trade Analyst, explores the rise in global gas prices amidst the unfolding events between Russia and Ukraine.

This article provides insight on the foreseeable future of the world’s largest exporter of gas, highlighting the predicament between Europe’s current sanctions and their dependence on Russian exports.

Srivastava writes: “The Ukraine crisis has sent global gas prices sky rocketing, but there may be bigger forces at work in the seaborne LNG market. While the world awaits developments on pipeline supplies, ship tracking data on seaborne LNG volumes may assuage the worst fears.

“The European benchmark TTF gas price has risen 135% so far in 2022, with a near-vertical spike since Russia commenced hostilities in Eastern Ukraine on February 24th. Russia is the world’s largest exporter of gas, and Europe is heavily reliant on this, as Russia exports approximately 23 Billion CBM of gas every day, about half of which goes to Germany, Italy, France and Belarus.

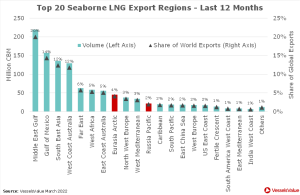

“Russia’s share of the seaborne LNG market is certainly large enough to move the needle on the global supply/demand balance. Of the top 20 export regions over the last 12 months, Russia accounted for two, highlighted in red in Figure 1 below. The Eurasian Arctic contributed 4% of total volumes and the Russian Pacific another 2%. However, there are four much larger export regions, which each account for double-digit shares: the Middle East Gulf (20%), the Gulf of Mexico (14%), Southeast Asia (12%) and West Coast Australia (also 12%). Smaller changes in any of these four regions can outweigh larger changes in the two Russian regions.”

Follow us on twitter