Lagos — Crude oil production in the US has recovered considerably from the lows seen during the first wave of the COVID-19 pandemic and the brief price war between Saudi Arabia and Russia. The country produced approximately 11.5 million barrels per day (mmbd) of crude oil in February 2022, a 19% gain over the May 2020 production of 9.7 mmbd, says GlobalData, a leading data and analytics company.

According to GlobalData’s latest report, ‘Unconventional Production in the US Lower 48, H2-2021’, oil production from the US Lower 48 (L48) shale plays has risen by 25% during May 2020 to February 2022. However, it is still around 8% below the pre-pandemic levels of 9.3 mmbd produced in December 2019.

According to GlobalData’s latest report, ‘Unconventional Production in the US Lower 48, H2-2021’, oil production from the US Lower 48 (L48) shale plays has risen by 25% during May 2020 to February 2022. However, it is still around 8% below the pre-pandemic levels of 9.3 mmbd produced in December 2019.

Ravindra Puranik, Oil & Gas Analyst at GlobalData, comments: “As most countries have eased COVID-19 restrictions that were in place earlier, global crude oil demand is anticipated to rise over the coming months. In line with this demand growth, the US shale oil production is also expected to grow further and could potentially reach the pre-pandemic levels by 2023.”

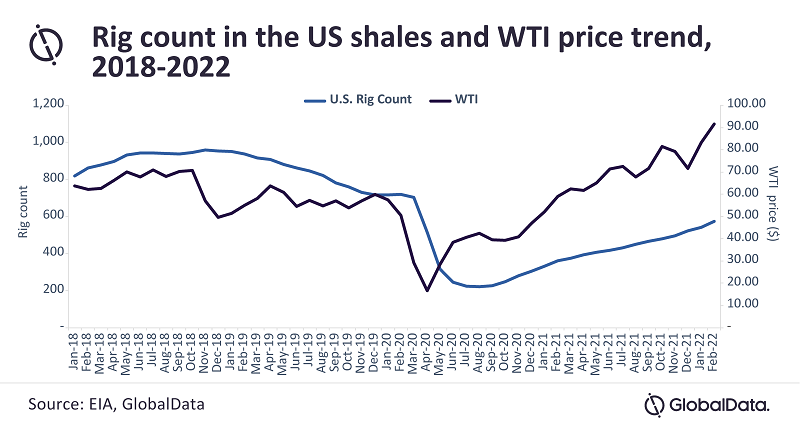

The industry downturn in 2020 had compelled operators to cut down their capital spending, which also led to a significant drop in the US rig count. Recently, the benchmark West Texas Intermediate (WTI) futures were averaging $91.64 in February 2022. The Energy Information Administration (EIA) expects WTI futures to average at $113 in March 2022 and possibly remain in this range depending on the duration of the ongoing Russia-Ukraine military conflict. These high levels of WTI would accelerate rig additions in the US shales that have risen nearly 60% in one year to 574 as of February 2022.

Puranik concludes: “Oil prices were on an upward trend even before the start of the Russia-Ukraine war as global demand was projected to outweigh supply in 2022. Since then, several companies, including oil majors BP, Shell, and ExxonMobil have decided to exit from the Russian oil and gas industry amid concerns over Western sanctions. Some of these companies may divert their capital—which was earlier allocated for Russian assets—to the US shales as the prevailing high prices make shale oil drilling highly profitable. This could further lift the hydrocarbon appraisal and development activity in the L48.”

Follow us on twitter