– Improved Margins into Latam, where Europe has become the most cost-effective supplier to Brazil, with up to a 5 cpg margin advantage over the USGC.

– Lower throughput projections and port restrictions are limiting Chinese gasoline exports, supporting the E/W spread.

– ARA emerges as the cheapest option for South Africa, adding to other African outlets like Kenya, Tanzania, and Nigeria.

– Emerging arbitrage and declining naphtha suggest a potential floor for gasoline’s early-year downturn.

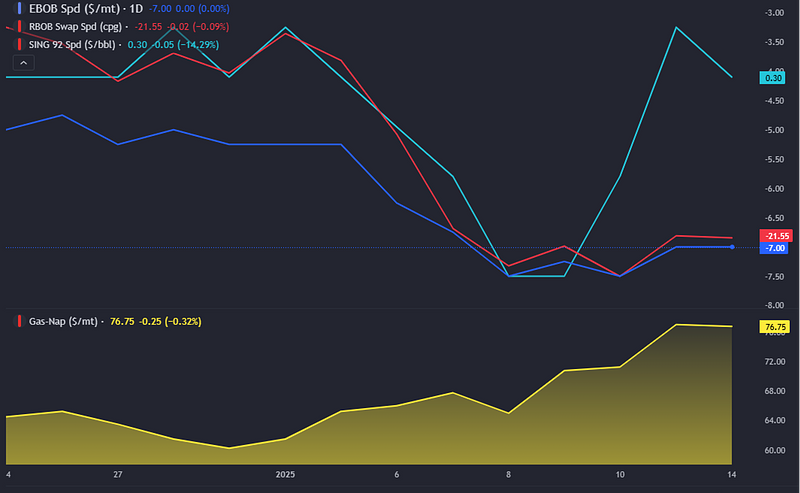

London — The gasoline market witnessed another week of deepening contango in the Atlantic Basin, affecting both EBOB and RBOB, while a rebound in Sing 92, reflected in a higher E/W, impacts the outlook for arbitrage from West to East.

However, the prolonged decline in EBOB, combined with an even sharper correction in the naphtha market, is starting to reveal new arbitage alternatives. These could stimulate EBOB timespreads in the short term, potentially helping to establish a floor for the recent early-year downturn.

The start of the year brought a steep contango in Europe, driven by the lack of export options in the West and worsening margins in the East observed since late December.

This left a strong contango as the only viable alternative to make storage profitable in the absence of outlets.

The EBOB Feb/March timespread collapsed to -$7.5/mt, approaching the seasonal historical low of the contract, set at -$10/mt.

However, the prolonged decline in naphtha prices has been sharper than that of gasoline in the West, gradually lowering blending costs and improving export options for the European market.

During the week, significant shifts in the competitiveness of the European barrel in Atlantic Basin outlets became evident. For example, in Brazil, where competition between USGC and ARA was evenly matched last week, Europe now stands out as the cheapest option, with a margin of up to 5 cpg for February arrivals.

New alternatives are emerging that could stimulate EBOB through arbitrage to the US. High storage levels in Europe have widened the TA arb, and combined with lower blending costs, the RBOB arbitrage margin is currently flat for the last February window.

Similarly, local blending margins for E5 and E10 are trending upward due to the cheaper naphtha. Although still closed for blenders, if naphtha continues to decline and EBOB strengthens amid new arbitrage opportunities, the margin could open in the short term.

Looking at the Asian market, the E/W spread surged significantly last week, gaining over $0.5/bbl for the January and February contracts.

The Sing 92 market has been the most directly impacted by the news from late last week. Expectations that independent refiners in China may operate at lower throughputs have renewed projections of declining Chinese gasoline exports.

Additionally, Shandong port restrictions on sanctioned vessels are now likely to further constrain China’s export volumes.

This rise in the E/W spread has also improved expectations for European gasoline exports to Africa, notably into South Africa, where ARA has become the most cost-effective option for February arrivals. This adds to other outlets such as Kenya, Tanzania, and Nigeria.

In summary, the gasoline market faces a volatile start to the year, marked by steep contango in the West on a well-supplied market and seasonal stock builds.

While deepening contango, high storage levels and cude strength have weighed on timespreads and cracks, new arbitrage opportunities to the Latam, US and improved export competitiveness to Africa are beginning to emerge, supported by declining naphtha costs.

Additionally, the rebound in Sing 92 and a stronger E/W spread highlight evolving export prospects to the East. These factors suggest potential stabilization in EBOB timespreads and a gradual recovery from early-year lows.

*Jorge Molinero is a Commodity Owner at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.