Houston — 2019 will mark the first time since 2014 the subsea market will have year-on-year growth, but declining oil prices could threaten this growth, according to analysis from energy research firm Rystad Energy.

Houston — 2019 will mark the first time since 2014 the subsea market will have year-on-year growth, but declining oil prices could threaten this growth, according to analysis from energy research firm Rystad Energy.

Essentially, oil prices must stay above the $50 per barrel threshold.

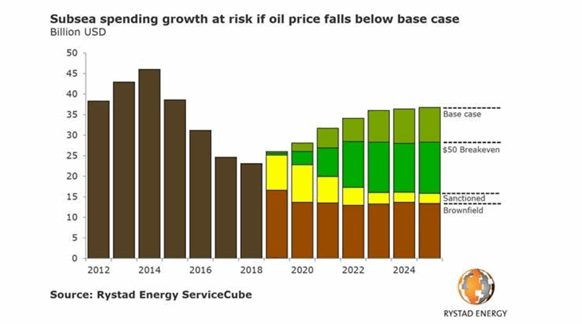

In its analysis of global subsea segments in coming years, Rystad noted 2019 development is secured with brownfield opportunities and projects that have already been sanctioned. But oil price will be the indicator of growth going forward.

If oil is $60 to $70, the subsea market will grow about seven percent each year until 2025. However, a large part of this activity is at risk if the price of Brent crude falls to $50 per barrel. In this scenario, Rystad forecasts this would be enough to support five percent annual growth in the subsea market through 2022, but after that, the growth rate is at risk of falling to zero.

“Although we expect the subsea market to have one of the highest growth rates within oilfield services, the segment is also more vulnerable to an oil price drop than the oilfield services market in general,” said Henning Bjørvik, analyst on Rystad Energy’s oilfield service team. “We see significant risks in terms of subsea spending as well as growth.”

The subsea equipment and subsea umbilicals, risers and flowlines (SURF) segments – all which have high exposure to greenfield activity – are at risk of having their growth cut by about five percentage points each year, according to Rystad.

Conversely, the oilfield services market as a whole exhibits about three percentage points’ growth at risk over the same timeframe.

This trend is repeated when looking at spending at risk from 2019 through 2025 – where close to 20 percent of spending in the subsea equipment and SURF segments is at risk, while around 10 percent of general oilfield services market spending is at risk if oil prices fall to $50 per barrel.

“It is worth mentioning that operators have had a remarkable ability to cut costs during downturns, much helped by the oilfield service industry,” Bjørvik said. “Should a lower price environment again become reality, we can be assured that the industry has a proven track record of survival and ingenuity.”

*email [email protected]