Bengaluru — A rally in oil is set to continue with prices staying well above $100 this year as a parched market struggles to wean itself off Russian oil, a Reuters poll showed on Thursday.

Bengaluru — A rally in oil is set to continue with prices staying well above $100 this year as a parched market struggles to wean itself off Russian oil, a Reuters poll showed on Thursday.

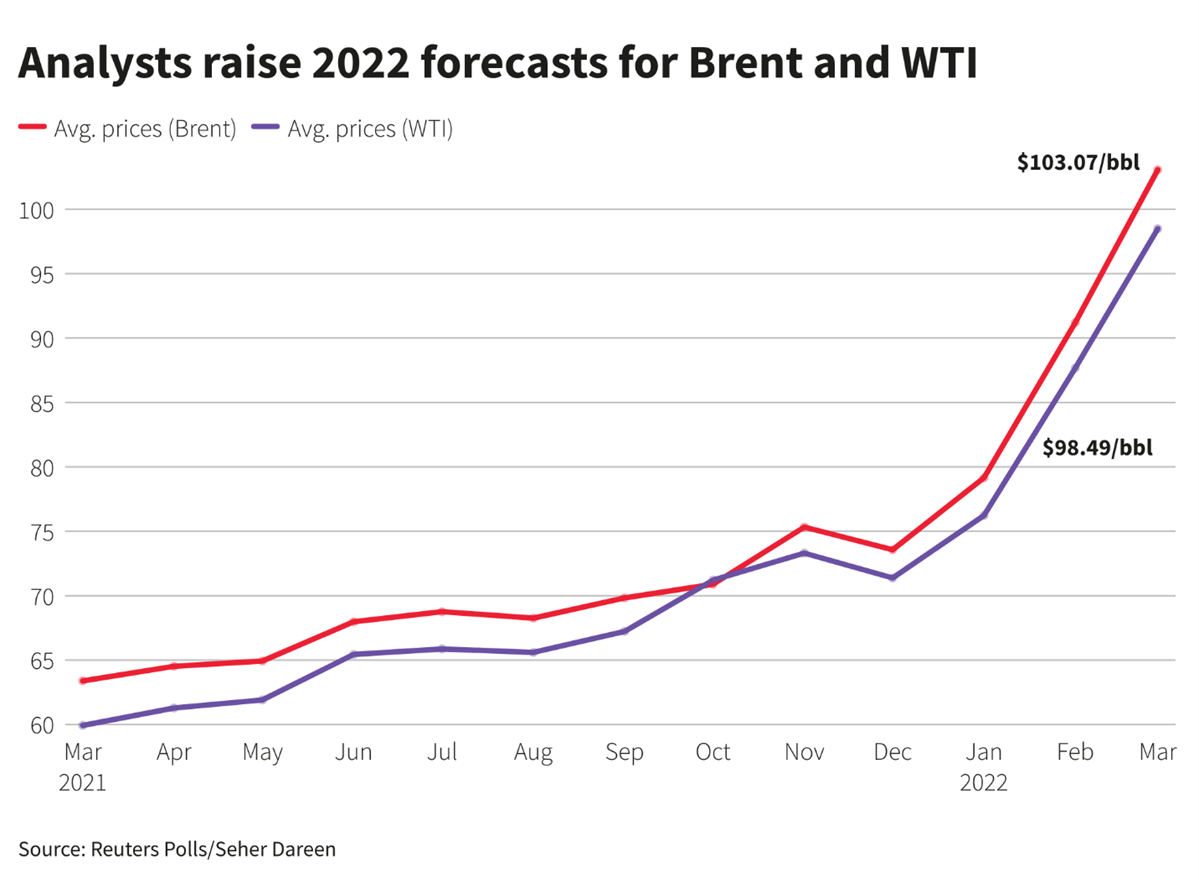

A survey of 40 economists and analysts forecast Brent crude would average $103.07 a barrel this year, a jump from the previous poll’s $91.15 consensus and the highest 2022 estimate yet in Reuters surveys.

The 2022 consensus for U.S. crude was also hiked sharply to $98.49 a barrel from the prior $87.68 forecast.

With Russia’s invasion of Ukraine entering a second month, global supply shortages approached 5 million to 6 million barrels per day (bpd) while demand has risen to record highs.

Russian exports make up about 7% of global supply. Fears over the fallout from the Ukraine war drove Brent to its highest in more than a decade in March to $139.13 per barrel.

“Geopolitics will steal the attention in the first half of the year,” said Edward Moya, senior market analyst at OANDA, adding that the war could lead to “intensifying moments that could eventually include an embargo on Russian oil and gas”.

But the focus could then shift to the level of demand destruction from persistent high prices, he said. read more

Storm damage to the Caspian Pipeline Consortium pipeline has exacerbated supply concerns, analysts said.

Despite supply concerns, the Organization of the Petroleum Exporting Countries, Russia and allies, a group known as OPEC+, are still expected to stick to a modest increase in output in May. read more

“OPEC+ is in a delicate position, with Russia being a key non-OPEC signatory to the production cut agreement,” said DBS Bank lead energy analyst Suvro Sarkar.

A deal between Iran and world powers on Tehran’s nuclear work could herald the return of Iranian barrels and relieve some supply worries, although an agreement has faced delays. read more

Poll respondents were divided on when the market would see a balance between supply and demand, with estimates ranging from the second half of 2022 to 2024.

“We will see no rebalancing before the war in Ukraine is over,” said Frank Schallenberger, head of commodity research at LBBW.

*Seher Dareen; Editing: Noah Browning & Edmund Blair – Reuters

Follow us on twitter