– OPEC+ cuts output by about 1.16 million bpd

– Hard to buy “pre-emptive” and “precautionary” reasoning -analyst

– Goldman Sachs raises Brent price forecast to $95 for 2023

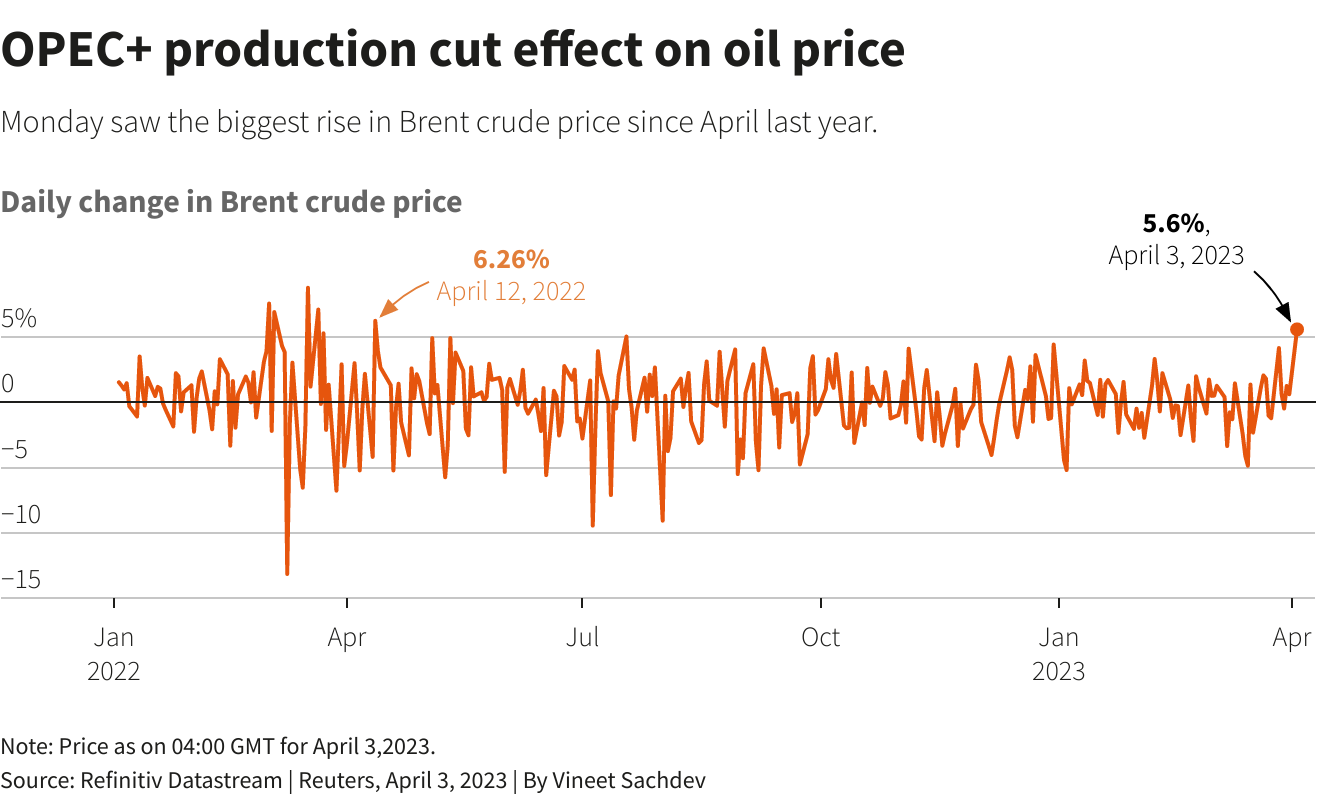

London — Oil prices surged on Monday, posting the biggest daily rise in nearly a year, after a surprise announcement by OPEC+ to cut more production jolted markets.

Brent crude was trading at $84.22 a barrel by 0900 GMT, up $4.33, or 5.4%, after touching the highest in a month at $86.44 earlier in the session.

U.S. West Texas Intermediate crude was at $79.84 a barrel, up $4.17, or 5.5%, after earlier hitting the highest level since late January.

The Organization of the Petroleum Exporting Countries and their allies including Russia shook markets by announcing further production cuts of about 1.16 million barrels per day (bpd) on Sunday.

The group, known as OPEC+, had been expected to maintain its earlier decision to cut output by 2 million bpd until December at its monthly meeting on Monday.

The pledges bring the total volume of cuts by OPEC+ to 3.66 million bpd according to Reuters calculations, equal to 3.7% of global demand.

As a result, Goldman Sachs lowered its end-2023 production forecast for OPEC+ by 1.1 million bpd and raised its Brent price forecasts to $95 and $100 a barrel for 2023 and 2024, respectively, it said in a note.

The Biden administration said the move announced by the producers was unadvisable and some analysts questioned OPEC+’s rationale for the extra production cut.

“It’s hard to buy the ‘pre-emptive’ and ‘precautionary’ reasoning – especially now, when the banking crisis had tailed off and Brent had crawled back up towards $80 from its 15-month lows earlier in March,” said Vandana Hari, founder of oil market analysis provider Vanda Insights.

The decision may mean OPEC+ still sees economic storm clouds on the horizon, Jorge Leon, senior vice president at consultancy Rystad Energy, said.

“These cuts may be signaling that OPEC+ believes that there are enough recessionary indicators in the market … (and) will further tighten the oil market for the rest of the year and could push prices above $100 per barrel”.

Brent fell last month towards $70 a barrel, the lowest in 15 months, on concerns that a global banking crisis and rising interest rates would hit demand despite lower OPEC oil output in March due to a halt in some of Iraq’s exports.

*Mohi Narayan & Florence Tan; Editing: Jamie Freed & Kirsten Donovan – Reuters

Follow us on twitter