London — For a sense of how competition for crude is intensifying among the world’s oil refiners, just look at the soaring premiums for one of Nigeria’s diesel-rich grades.

Egina crude is being offered by China’s biggest offshore driller CNOOC at a $13 a barrel premium to London’s Dated Brent price, said traders who asked not to be identified. A prior trade took place at about $10 a barrel above the same marker, they said. Both shipments are due to be loaded next month, the people said.

Egina crude is being offered by China’s biggest offshore driller CNOOC at a $13 a barrel premium to London’s Dated Brent price, said traders who asked not to be identified. A prior trade took place at about $10 a barrel above the same marker, they said. Both shipments are due to be loaded next month, the people said.

The crude is popular because it’s a reliable stream with a greater output of middle distillates than its rival Nigerian grades such as Forcados and Bonga, according to traders. The crude’s yield of low-sulfur gasoil is more than 40%, according to a presentation from TotalEnergies SE, which said its naphtha and kerosene properties also appeal to refiners in Asia.

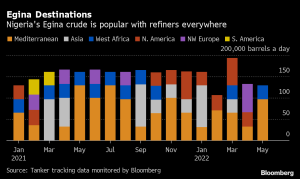

Distillate-rich crudes are currently popular with refiners in Asia and northwest Europe alike as diesel margins have reached their highest level since at least 2011 when Bloomberg began compiling the data.

To be sure, the final price could be lower than the offered level, particularly if the cargo goes to Europe where freight costs are lower and there is increased competition with rival sweet grades from north Africa and the US, according to traders who specialize in West African crude.

Regular buyers of Egina in the past year have included Portugal’s Galp, Canada’s Irving Oil, Indian Oil Corp., Indonesia’s Pertamina and Israel’s ORL, according to data compiled by Bloomberg.

Egina’s differentials could also set the tone for other crudes that share some of its qualities, such as Malaysia’s Labuan grade. Spot trading of Asia-Pacific as well as Middle Eastern grades is set to get underway in a few days.

*Serene Cheong, Bill Lehane, Julian Lee – Bloomberg

Follow us on twitter